How to choose the best Mortgage Broker Geelong

Choosing the best Mortgage Broker Geelong

Buying a home and taking out a home loan of any size is a big commitment. Whether it be your first house or your third, the process can be both daunting and overwhelming. Having an expert mortgage broker on your side to help guide you through the process can make a world of difference to your home buying and lending experience.

With endless options at your fingertips when it comes to Mortgage Brokers, it’s essential to find one who can work with you, and your family’s needs effectively and help you secure a suitable home loan.

To choose the best mortgage broker in Geelong for you, a little bit of research will go a long way to help with your decision. To help streamline the process for you, there are several things that you should take into consideration to help with your decision.

What exactly can a Mortgage Broker do for me?

Mortgage brokers essentially work as the link between you, and various lenders, both with banks and non-bank institutions.

We always have your best interest at the forefront of our minds. We work to align your individual requirements with the loan’s attributes to ensure you get the most out of your home or business loan, ensuring the most favourable rate is secured for you on every occasion.

Having an experienced mortgage broker on your side, takes the stress off your shoulders, as it is our job to research and compare the market to suit your needs, communicate with your chosen lender (so you don’t have to) and help guide you through the entire process. Answering any questions you have throughout the process, as well as assisting with finalising paperwork.

Researching for the best Mortgage Broker

Doing thorough research may seem overwhelming, but trust us, starting your journey with proper research will simplify the rest of the process. This groundwork will equip you with the knowledge and expertise similar to that of a Mortgage Broker, who will take care of the rest for you!

How extensive is their experience?

Experience matters. If it didn’t, you would most likely just roll with the first Mortgage Broker that appeared on the top of your Google search and your experience may be underwhelming.

Look into how many years of experience they have. The more years of experience they have under their belt, the more confidence you will have knowing you are in the right hands when you find a mortgage broker best suited for you.

Whether you are looking into the services of a company, or an individual, some of the most important questions to find the extent of their experience are:

What qualifications and accreditations do they have?

Qualified mortgage brokers should have the following:

- Certificate IV in Finance and Mortgage Broking

- Be accredited under the National Consumer Protection Act

- Be a member of the Mortgage & Finance Association of Australia (MFAA) and/or the Finance Brokers Association of Australia (FBAA)

Are they licensed?

All mortgage brokers should have their own Australian Credit Licence or alternatively, as required by the Australian Securities and Investments Commission (ASIC), they should be qualified to act as an authorised Credit Representative.

How many lenders have they worked with?

Brokers are limited to a list of banks they can obtain loans from, which is referred to as their “lender panel.”

Ensuring your broker has worked with multiple lenders is crucial for your financial interests as it provides you with a wider range of loan options.

A reliable broker should have a diverse range of lenders on their panel, as it will help to utilise different options based on the borrowers’ situation. It is best to confirm the number of lenders the broker has on their panel, how many they work with, and inquire about the reasons behind their choices.

Do they have positive reviews?

Customer testimonials provide the most authentic insight into a product or service. Explore their Google reviews to read about others’ experiences. What do customers say about the services reliability, friendliness, and honesty? How prompt was their response?

Ideally, a reputable mortgage broker will have a portfolio of satisfied customers to share with the community and potential new clients.

If any of your family or friends have engaged with the services of a mortgage broker recently, ask them about their experience. Were they satisfied with their broker, and the guidance received? What qualities would they seek in their future broker?

What are the fees, charges & commissions?

By law, mortgage brokers must explain exactly how they are compensated, or paid. Typically, brokers earn a commission based on a percentage from the bank that is granting the loan, which is why there is no costs associated for you to use the services of a mortgage broker.

Consider it a warning sign if a broker struggles to address fundamental inquiries regarding charges, commissions, and ownership structures. Any reliable mortgage broker should consistently provide clear and transparent information about their business operations and services.

Find the best Mortgage Broker Geelong at The Hrkac Group

If you are looking for the best Mortgage Broker Geelong, our team at the Hrkac Group is here to provide you with practical and effective financial advice.

We’ll assist you in finding the best home, or business loan solution tailored to your specific needs. Our honest, knowledgeable team of Geelong mortgage brokers will give you the confidence to negotiate for your future, so together, we can develop and maintain your wealth with our transparent approach.

Contact our team of Mortgage Brokers today on (03) 5224 2366 or book an appointment here.

If you have had your current home loan for a number of years, it is likely your needs have since changed. That, or you may be missing out on flexible features or add-ons that have since become available.

Refinancing your home involves paying out your current loan with a new one. In many cases, this will be with a different bank entirely. Why? This may allow you to select certain features that better suit your lifestyle, wants and needs.

Here are 8 reasons why you could consider refinancing your home:

1. Save on Fees

Your interest rate will have a significant impact on how much you actually pay on your mortgage. If you have had your loan for a number of years, you may be paying loyalty tax. This is when lenders charge long-term customers a higher interest rate, compared to new customers. Securing an interest rate just 0.5% lower than your existing loan can see you save thousands. Ultimately resulting in your loan being paid off quicker, and who doesn’t want those extra dollars in their pocket?

It is important to remember your home loan is more than the interest rate. All lenders measure their rates differently, which is why it is so important to speak with a Lending Specialist or Mortgage Broker to ensure you are reviewing all aspects of the loan before making the change.

2. Customise your loan

It is likely that your personal circumstances will change over the course of your home loan and you may need to alter your loan accordingly. When getting your home loan years ago, it may have included features that no longer suit you today, or you have found that over time, the features on your current loan are just not being maximised. Adding or removing features to better suit your lifestyle can help give you the flexibility you need. There are a range of features available to you, including flexible repayments, redraw facilities or even offset accounts. As always, it is best to consult our team of Geelong Mortgage Brokers to explore the best path for you.

3. Opt for a fixed rate

Fixed rates work really well in the right situations however upon the end of your fixed rate term, you will be transferred to a higher variable rate by default. However, refinancing your fixed loan once it has ended, may help you avoid having to pay any associated fees with leaving a fixed home loan early.

4. Access home equity

If you want to access your home equity, refinancing is the way to do it. Your equity is the portion of your home that you own outright. You can calculate your equity by subtracting your remaining home loan from the balance of your home’s current value. Accessing your equity can then help fund major purchases or investments.

5. Investment Opportunities

Refinancing your home can help you maximise your equity on your home. You could then use those funds to invest in real estate, shares, or other opportunities.

7. Facilitate Renovations

Enhance your property’s value and move closer to achieving your dream home by undergoing renovations on your property. To avoid having to take out a new loan to fund your renovations and ensure your savings stay in your bank, think about using the equity in your home which can be unlocked by refinancing your home.

7. Debt Consolidation

You may have other debts, including personal loans, car loans or credit cards.

Debt consolidation involves combining those other debts with your home loan. This simplifies repayments and makes managing your repayments more convenient.

8. Switching Lenders

You may not be 100% satisfied with your current lender. This could be due to a number of factors, some of them being: inadequate website, mobile app or in-person services, inflexible repayment methods or a negative experience with the customer service provided. Whatever the reason, if you do decide to refinance based on the lender, ensure you are taking into consideration all aspects of the new loan and not just the lender.

Geelong Mortgage Brokers at The Hrkac Group

If you are considering refinancing your home loan, there are steps you need to take to ensure you are eligible to do so. Our team of Geelong Mortgage Brokers are dedicated to helping you ensure your home loan journey is as simple and stress-free as possible. We have access to a range of home loans offered by banks and non-banking lenders, to ensure we find the best suitable option for you.

Take control of your financial future by meeting with our team of Geelong Mortgage Brokers and home loan specialists at The Hrkac Group. Make an appointment today via our Contact Us page, or phone us on (03) 5224 2366.

General Advice Warning

This information has been provided as general advice. We have not considered your financial circumstances, needs, or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication. Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly, neither nor its related entities, employees, or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

The dream of owning a home is deeply ingrained in Australian culture. For many, it represents a significant milestone in their lives, symbolising financial security and stability. But, the rising cost of housing in many parts of Australia has made this aspiration increasingly challenging for first-time buyers.

Furthermore, the dream of owning a home has been made even more difficult due to stricter lending practices by banks, sluggish wage growth relative to inflation, and concerns about fluctuating interest rates. In response to this challenge, commencing on July 1st, 2023, the government’s Home Guarantee Scheme expanded its eligibility criteria. It has been made to be more accessible for individuals who have long aspired to homeownership.

Understanding the First Home Guarantee Scheme

The First Home Guarantee is an Australian Government initiative. It’s aimed at speeding up the ability to buy a home for eligible buyers. The Scheme comprises several key components, each aimed at assisting first-time buyers in different ways:

-

First Home Guarantee

This component of the Scheme helps eligible first-home buyers secure a home loan with a lower deposit. Typically, banks require a deposit of at least 20% of the property’s value. Under the scheme, eligible buyers can purchase a home with as little as a 5% deposit. The government guarantees the remaining portion of the deposit, effectively eliminating the need for costly Lenders Mortgage Insurance (LMI). This makes homeownership more attainable for those who may have been struggling to save a large deposit.

Beginning on July 1, the upcoming changes will extend eligibility beyond singles and de-facto couples. Now encompasses family members, siblings, and friends who can collaboratively apply and divide the expenses associated with a first home deposit.

-

Regional First Home Buyer Guarantee

This program is for eligible first-home buyers looking to purchase their first home in a regional area. It enables them to do so with a deposit as low as 5%, without incurring the expenses associated with LMI.

On July 1, the upcoming changes will extend eligibility beyond singles and de-facto couples to encompass family members, siblings, and friends who can collaboratively apply and divide the expenses associated with a first home deposit.

-

Family Home Guarantee

This initiative offers eligible single parents with dependents the opportunity to apply for a mortgage with as little as a 2% deposit, without attracting LMI, thanks to the government acting as guarantor. It’s accessible to both first-time homebuyers and single parents seeking to enter or re-enter the property market, whether they intend to purchase an existing property or build a new home. This scheme is intended to help alleviate some of the financial stress that often accompanies single parenthood.

Starting from July 1, the forthcoming changes will broaden eligibility criteria to encompass not only single parents but also single legal guardians of children, including siblings, aunts, uncles, and grandparents.

Who’s Eligible to Apply?

To apply for the Scheme, following the changes that took effect on July 1, prospective homebuyers must meet the following criteria:

- Citizenship or Residency: Applicants must be Australian citizens or permanent residents at the time they enter into the loan. Commencing July 1, permanent residents will now be eligible for all three guarantees offered under the scheme.

- Age Requirement: Homebuyers must be at least 18 years of age to be eligible.

- Income Limits: The income threshold for eligibility is an annual income of up to $125,000 for individuals or $200,000 for couples, as indicated on their Notice of Assessment issued by the Australian Taxation Office.

- Deposit: A minimum deposit of 5% of the property’s value is required. However, for those applying for the Family Home Guarantee, a minimum deposit of 2% is sufficient.

- Owner-Occupancy: Applicants must intend to use the purchased property as their primary residence, establishing them as owner-occupiers.

- First Homebuyer Status: Eligibility extends to first-time homebuyers who have not previously owned or held an interest in a property in Australia. Additionally, homebuyers who have not owned a property in the past 10 years are eligible under the scheme.

- Loan Approval: Applicants should be capable of securing a loan through a participating lender.

What Type of Property can be Bought?

In order for a property to qualify for eligibility, it must meet the criteria of being categorised as a ‘residential property’. Residential properties that meet the eligibility criteria encompass the following:

- An existing house, townhouse, or apartment

- A house and land package

- Land and a separate contract to build a home

- An off-the-plan apartment or townhouse

The program aids in acquiring or constructing a modest home, with the condition that the residential property’s value does not surpass the applicable price cap for its location. The specific price caps for capital cities, major regional centres, and regional areas can be referenced here.

Key Considerations when Financing Your New Home

When it comes to financing your new home, it’s essential to temper your excitement with thoughtful consideration and careful decision-making. Owning a home is a significant step. It demands thorough research and prudent choices that can profoundly impact your future as a homeowner. Several key considerations should include:

-

Type of Home

Begin by defining the type of home you’re seeking. Are you in pursuit of your dream home, or is an entry-level home more aligned with your current goals? Consider your family’s needs, the required space, and whether the home should accommodate future growth. Additionally, assess if the neighbourhood matches your lifestyle preferences and necessities.

-

Financial Assessment

Evaluate your financial situation. Determine the amount you can save for a deposit, as a larger deposit can reduce long-term interest costs on your loan. Ensure your income and financial stability align with your new home purchase and think about whether you’ll be able to consistently service your mortgage. Explore potential government initiatives or subsidies for which you may be eligible.

-

Home Loan Considerations

Delve into the specifics of your home loan. Have you consulted with a mortgage broker to explore various loan options? Understand whether you’ll be subject to paying LMI and assess whether a fixed or variable interest rate is more suitable for your circumstances. Additionally, consider whether you’ll secure your home loan through a traditional bank or an alternative lender.

Mortgage Brokers Geelong

By taking these factors into account and speaking with our expert mortgage brokers in Geelong, we can help you confidently finance your new home and set a solid foundation for your homeownership journey.

The expert lenders at The Hrkac Group are committed to helping borrowers get the most from their lending. Our team of financial experts can help you create a financial plan that works for you and your individual circumstances and can help you make the right decision about managing your home loan. If you want to discuss your options, speak to an expert Geelong Mortgage Broker at The Hrkac Group.

Our Geelong Mortgage Brokers’ expertise and experience in facilitating your home loan can help ensure a positive experience for you. To make an appointment to meet one of our friendly Geelong Mortgage Brokers, feel free to contact us via email or phone (03) 5221 2355.

The information provided in this blog is of a general nature only and is not intended as either advice or recommendations and is not tailored to your specific circumstances. Please also note that this does include any information on any Payroll requirements imposed by any State or Territory Governments outside of the State of Victoria. Please contact our partner – SIBS Bookkeeping team or us – the Hrkac Group Accountants team – if you would assistance as to how, or if, any of the abovementioned would apply to you.

Liability limited by a scheme approved under Professional Standards Legislation.

In the realm of personal finance, the term “credit score” often comes up, though many are unsure of its significance. Credit scores often serve as a crucial component in the decision-making process of potential lenders and creditors. While credit scores are not the sole determinants of your financial fate, they provide a general assessment of your suitability for a loan.

In this comprehensive guide, we explore the ranges of credit scores, shed light on a lender’s perspective, examine the factors that impact credit scores, and offer actionable strategies to cultivate responsible credit behaviour. By understanding the nuances of credit scores and proactively managing your financial health, you can unlock opportunities for better loan terms and financial well-being.

What is a credit score?

A credit score is a three-digit number ranging from 300 to 850. Credit scores are calculated using information in your credit report, including your payment history, the amount of debt you have, and the length of your credit history.

There are many different scoring models, and some use additional data in their calculations. Credit scores are used by potential lenders and creditors, such as banks, credit card companies, or car dealerships, as one factor when deciding whether to offer you credit, like a loan or credit card. It helps them determine how likely you are to pay back the money they lend.

So what is a good credit score?

When it comes to credit scores, it’s important to understand that everyone’s financial and credit situation is unique, and there is no “magic number” that guarantees better loan rates and terms. However, credit scores can provide a general assessment of your creditworthiness.

Here are the typical credit score ranges:

- Fair Credit: Scores ranging from 580 to 669 are considered fair.

- Good Credit: Scores between 670 and 739 fall into the good credit range.

- Very Good Credit: Scores from 740 to 799 are categorized as very good credit.

- Excellent Credit: Scores of 800 and above are considered excellent.

Lenders tend to categorise borrowers based on their credit scores to assess risk and determine loan terms.

Here’s how lenders generally view borrowers based on credit scores:

- Acceptable or Lower-Risk Borrowers: Individuals with credit scores of 670 and above are seen as acceptable or lower-risk borrowers. They are more likely to qualify for favourable loan terms and credit opportunities.

- Subprime Borrowers: Those with credit scores ranging from 580 to 669 fall into the category of subprime borrowers. They may face challenges in qualifying for better loan terms due to their credit score, as lenders consider them to be at a higher risk compared to those with higher scores.

- Poor Credit Range: Borrowers with credit scores below 580 generally fall into the poor credit range. They may encounter difficulties in obtaining credit or qualifying for better loan terms, as lenders perceive them to be high-risk borrowers.

Different lenders have different criteria when it comes to granting credit, which may include information such as your income or other factors. That means the credit scores they accept may vary depending on that criteria.

Credit scores may differ between the three major credit bureaus (Equifax, Experian, and TransUnion) as not all creditors and lenders report to all three. Many creditors do report to all three, but you may have an account with a creditor that only reports to one, two, or none at all. In addition, there are many different scoring models available, and those scoring models may differ depending on the type of loan and lenders’ preference for certain criteria.

What Factors Impact Your Credit Score?

Here are some tried and true behaviours to keep top of mind as you begin to establish – or maintain – responsible credit behaviours:

- Pay your bills on time, every time. This doesn’t just include credit cards – late or missed payments on other accounts, such as cell phones, may be reported to the credit bureaus, which may impact your credit scores. If you’re having trouble paying a bill, contact the lender immediately. Don’t skip payments, even if you’re disputing a bill.

- Pay off your debts as quickly as you can. By reducing your overall debt load, you can improve your credit utilisation ratio, which is the amount of credit you’re using compared to your total available credit. A lower credit utilisation ratio can positively impact your credit score.

- Keep your credit card balance well below the limit. A higher balance compared to your credit limit may impact your credit score. Aim to keep your credit utilisation ratio below 30% to maintain a good credit score.

- Apply for credit sparingly. Applying for multiple credit accounts within a short time period may impact your credit score. Each application typically results in a hard inquiry on your credit report, which can temporarily lower your credit score. Only apply for credit when you truly need it and can responsibly manage additional credit accounts.

- Check your credit reports regularly. Request a free copy of your credit report and check it to make sure your personal information is correct and there is no inaccurate or incomplete account information. You’re entitled to a free copy of your credit reports every 12 months from each of the three nationwide credit bureaus by visiting www.annualcreditreport.com. By requesting a copy from one every four months, you can keep an eye on your reports year-round. Remember: checking your own credit report or credit score won’t affect your credit scores.

- Dispute inaccuracies. If you find information you believe is inaccurate or incomplete, contact the lender or creditor. You can also file a dispute with the credit bureau that furnished the report. At Equifax, you can create a myEquifax account to file a dispute. Visit our dispute page to learn other ways you can submit a dispute.

A good credit score is crucial for accessing favourable credit terms and opportunities. It represents your creditworthiness and the likelihood of paying back borrowed money. By understanding how credit scores are calculated and practicing responsible credit behaviours, you can work towards achieving and maintaining a good credit score, which opens up doors to better financial opportunities. Remember, building good credit takes time and discipline, but the effort is well worth it in the long run.

Mortgage Broker Geelong

As you prepare to take the leap into home ownership, it’s important to consult with a Mortgage Broker to understand your obligations.

The expertise and experience of our Geelong Mortgage Broker team at The Hrkac Group can help you with securing a home loan. If you need assistance or advice, please get in touch. To make an appointment to meet with one of our friendly Geelong Mortgage Brokers, contact us via email, or phone (03) 5224 2366.

Liability limited by a scheme approved under Professional Standards Legislation.

The Reserve Bank of Australia has said it expects about half of all outstanding fixed home loans to switch to variable rates in 2023. This equates to around 800,000 home loans, totalling about $350 billion.

Many Australians were lucky to lock in record-low fixed interest rates on their mortgages in the last few years; but for some, this may be coming to an end in 2023. This will leave affected households paying two to three times their current fixed rate, due to rapidly rising interest rates.

If your fixed-rate home loan is approaching its end, you’ll need to make some decisions. Should you re-fix your loan at a new rate, change to a variable rate, or even consider refinancing to a new mortgage provider?

In this article, we’ll talk through your options when it comes to preparing for the end of your fixed interest rate.

What is a fixed-rate mortgage?

A fixed-interest rate home loan is one where the rate of interest you pay on your mortgage is locked in for a certain period. In Australia, a fixed rate typically lasts between one and five years. During the time your rate is fixed, your interest rate and your compulsory repayments won’t change.

If you fix your interest rate when interest rates are low, you could be saving yourself from paying more when interest rates rise. But for this reason, fixed interest rates tend to be a bit higher than variable rates. While it makes it easier to budget for the future as you know exactly what your repayments will be, you could also be missing out on big savings when the interest rate falls.

Also, many fixed-rate mortgages do not have offset accounts, which means that extra savings cannot be used to reduce interest paid on the loan. With a fixed rate, you are sometimes impeded in terms of how quickly you can pay off the loan. A break fee may be incurred if you want to pay it off early.

What is a variable rate mortgage?

A variable-rate home loan features an interest rate that may change over time, according to the rise and fall of interest rates. If you choose a variable rate home loan, you may be able to take advantage of any interest rate decreases over your loan’s term, meaning you pay less interest on the home loan balance and your repayments go down.

On the other hand, when the interest rate increases, so too will the amount of interest you’re paying, meaning your repayments will go up.

How can I prepare for the switch?

If you don’t do anything before your fixed term rate lapses, your mortgage provider generally switches your loan to its standard variable rate, which can be much higher than some of the discounted options available to new customers.

If you are worried about what will happen when your fixed-rate mortgage ends, you should speak to a trusted financial expert at your earliest convenience. This helps you avoid any scenario where you are stuck with the imposed rate your current lender offers when the fixed rate period ends.

It’s important to research your options because, with each rate increase, your borrowing capacity can be reduced because lender calculations on household expenditure and expenses change. And as house prices fall, you could end up owing more on your house than what it is currently worth. Here are the steps we recommend you take prior to the end of your fixed interest rate.

- Negotiate with your current lender

Speak to your current lender in advance to find out what your rate will change to. This gives you an opportunity to compare with other rates available in the market and think about whether switching providers is right for you. You could also negotiate a better rate to save you the effort of moving to a new provider. - Research what other lenders can offer

See how your loan stacks up against other home loans out there to determine if you’re getting a competitive interest rate. If you do find a better offer, switching providers can be the right move. But make sure you’re aware of the costs involved in switching, as borrowing costs and fees can sometimes be greater than the amount you would save. - Consider re-fixing your home loan

Even though now may not be the best time to go with this option, if you have enjoyed the certainty that comes with a fixed-rate loan, you can refix your mortgage with an up-to-date interest rate. However, you will be locked into the new fixed interest rate for a period of your loan term, unless you choose to end the contract earlier which may result in break fees. Be sure to also carefully check out the features of a fixed loan too, such as fee-free extra repayments, redraw, and linked offset accounts. Many fixed-rate loans do not provide these features. - Consider splitting your loan

If you can’t decide on a variable or fixed rate, or if you want a combination of flexibility and predictability, you can potentially have part of your mortgage fixed and part variable. For example, you could have 60% of your loan on a fixed rate and 40% on a variable rate. This approach can offer you the best of both worlds. The variable rate component lets you take advantage of any interest rate falls, while the fixed portion shelters part of your loan from rising interest rates. - Talk to a trusted lending professional

If you can’t decide which option is best for you, a mortgage expert may be able to offer you advice. They can look at your finances and recommend options that suit your specific needs. They’ll also be able to guide you through the process of switching to another provider if that’s what you decide.

If you are worried about what will happen when your fixed-rate mortgage ends, you should speak to a trusted financial expert at your earliest convenience. Before you make any decisions, crunch the numbers with an online mortgage switching calculator.

The expertise and experience of our Geelong Mortgage Broking team at The Hrkac Group can help you with your home loan, whether it’s securing a new interest rate for you, refinancing your current loan, or discussing the finance of an investment property. To make an appointment to meet with one of our friendly Geelong Mortgage Brokers, contact us via email or phone (03) 5224 2366.

Liability limited by a scheme approved under Professional Standards Legislation.

With the state of the world’s economies, persistently high and rising inflation, and so much uncertainty, homeowners are bracing themselves for even more rate hikes from the Reserve Bank of Australia (RBA). This is impacting Australians in all aspects of their spending, and even though housing prices are reported to be declining, homeowners are still being forced to borrow more and more to enter the market.

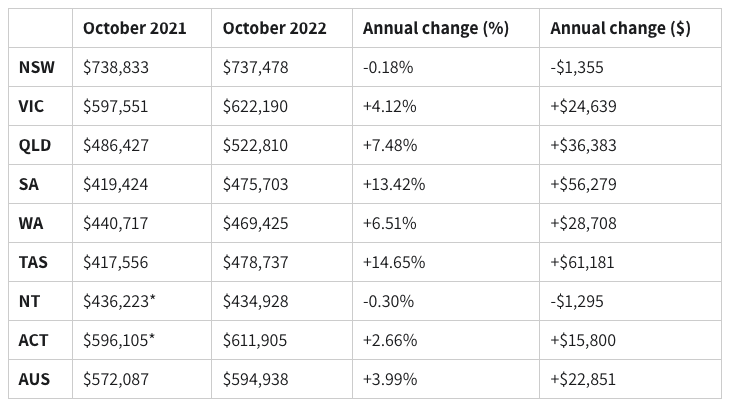

The latest lending indicators from the Australian Bureau of Statistics (ABS), in the table below, show that the average mortgage size (for owner-occupier dwellings) was $594,938 in October 2022 — up from $572,087 in October 2021.

Although the average Australian home loan has only increased by $22,851 this is after the impact of surging property prices that was witnessed across the country over the pandemic. According to property research firm CoreLogic, Australian housing values increased 28.6% over the latest upswing, which equates to an average increase of $170,700.

Lenders are feeling the burden of increasing interest rates, rising inflation, and increases in loan repayments.

Average loan size by state and territory — October 2021-22 (Source: ABS)

Where is the market headed?

The current trend of the Australian property market is being driven by how the rate hikes have affected affordability. There has been a decrease in demand for purchasing homes and an increase in home listings. With a shift in demand towards cheaper and more affordable homes like units. This is likely to continue driving growth in the unit sector while the housing market is levelling off.

As a first home buyer, most of the average loan values listed above are still below the state and territory property price caps for the First Home Loan Deposit Scheme and New Home Guarantee initiatives. These schemes allow eligible first home buyers to purchase a home with as little as 5% deposit without paying Lenders Mortgage Insurance, which on average helps people purchase their first home 4 years sooner. So taking advantage of these schemes is a great tool helping you get into the market sooner before prices and the amount you need to borrow rises.

No one gets ahead by waiting

Amid the confusion of interest rates, inflation, property prices stabilising, many are wondering if now is the time to buy. If you got one lesson out of the pandemic, it should have been buy and buy now. During the early stages of the pandemic, many people held back from buying with so much uncertainty and fears of a property price crash. However, the opposite occurred and prices soared, leaving those who were just watching in the dust. Instead of trying to time the market perfectly, you should aim to buy as soon as you have a deposit and your finances in order. The sooner you get into the market, the more time you will have to benefit from your property’s growth.

The expertise and experience of our Geelong Mortgage Broking team at The Hrkac Group can help you in the process of obtaining a home loan, refinancing your current loan, or to discuss the finance of an investment property, whatever your personal circumstances. To make an appointment to meet with one of our friendly Mortgage Brokers today, feel free to contact us via email or phone (03) 5224 2366.

The information provided in this blog is of a general nature only and is not intended as either advice or recommendations and is not tailored to your specific circumstances. Please also note that this does include any information on any Payroll requirements imposed by any State or Territory Governments outside of the State of Victoria. Please contact our partner – SIBS Bookkeeping team or us – the Hrkac Group Accountants team – if you would assistance as to how, or if, any of the abovementioned would apply to you.

Liability limited by a scheme approved under Professional Standards Legislation.

If you have a home loan, or are in the market to buy a house, you are most certainly aware by now that interest rates are rising at a rapid rate. The Reserve Bank has this month raised the cash rate by 0.5 of a percentage point for the fourth straight month in a row, and governor Philip Lowe has said the board expects to increase interest rates even further over the months ahead. The cash rate target of 2.35 per cent is the highest since the beginning of 2015. As a result, home loan rates are also certain to rise.

Governor Lowe’s post-meeting statement once again reiterated that the bank’s board is “committed to doing what is necessary” to bring inflation back within the bank’s 2-3 per cent target range “over time”. Analysis by RateCity suggests that this most recent increase will add an extra $200+ per month to repayments on a $750,000 mortgage. The total increase in monthly repayments on a $750,000 mortgage since the RBA began lifting the cash rate from its all-time low of 0.1 per cent in May, will be over $900.

These rises aren’t unprecedented; in 1994, the cash rate went from 4.75 per cent to 7.5 per cent in just five months. All the same, things may be feeling a bit scary in your household right now. So what should you do in response? Here are five suggestions:

1. Don’t panic

Don’t panic, there are many ways to survive and thrive in these challenging times. Your lender wouldn’t have approved your mortgage unless they were sure that you could cope with a worst-case-scenario series of rate rises. So unless your financial position has severely deteriorated since then, you should be able to cope with higher repayments. While a higher mortgage repayment may strain your budget and certainly cause concern, it’s most likely never going to get to the point where you must default on your mortgage. Soaring rates, increasing inflation, and oil price hikes are all part of the economy. There are things you can do to prepare for rate rises and keep your finances on track.

It may help to understand exactly how the rate increases will impact your bottom line. If you have a financial planner, mortgage broker or someone who can assist you in these matters, book in a catch up. By understanding how much more money you need to find each month, you can start to make the proper arrangements. Stay positive and don’t despair. Rising interest rates can be challenging. Talk to one of our expert lenders if you need help understanding your options.

2. Get ahead of any problems

If you think you might struggle to continue making your repayments, contact your lender now to discuss your options. It’s important you make contact before you miss a repayment, not after, because the more warning you give your lender, the more flexible they’re likely to be. No one wants you to default on your loan. Understand your options. If you’re struggling to make ends meet, there are other avenues you can take.

When speaking to your lender about your circumstances, see if they have available options to defer, pause or reduce your repayments if you are suffering from financial hardship. Many lenders in Australia offer a hardship policy, and you should speak to them if you feel the situation is becoming too difficult for you to manage.

3. Budget for rate rises

Make a budget and commit to it. This will help you stay across your finances and ensure you’re not overspending. Understanding where your money goes is important for anyone, under pressure from rate rises or not. If you don’t already have one, create a budget that encompasses all of your income and all of your expenses. Make sure that you capture everything, including major expenses (such as loan repayments, bills, groceries, and fuel) and also smaller expenses and luxuries, (like take-away, streaming services, etc.). Once you have an idea of your actual cash flow, you can start to make more informed decisions about your spending.

If rates increase, you must find the increased repayment in the budget somewhere. Assume your mortgage rate will rise by 2 percentage points. Calculate what your new monthly repayment would be and start paying it now. You can put the extra money into an offset account, a redraw facility or a special savings account. If you have a variable home loan, an offset account can be a useful tool. You can still use it as a regular transaction account but, just by having the money sitting there, it reduces how much interest you’re paying on your loan.

4. Improve your savings rate

Finding crafty ways to reduce your expenses could give you a bit more breathing room as rates rise. When times become a little tougher, it’s always good to look at where your money is going and try to reduce your habit-spending where possible. We tend to overlook smaller purchases, like your daily take-away coffee, that bottle of wine with dinner, or other minor impulse purchases. Perhaps you could skip dining out every couple of weeks, cancel your weekly meal box or reassess some of the household brands you buy. Reducing your overall spending is the main objective if you find yourself needing to free up some extra cash to make way for increased repayments.

Now could also be a great time to ask for a raise or a promotion. Employees are in a unique position to ask for a raise this year, because high inflation and tight labour markets are expected to continue. Additionally, you could look for new income opportunities on the side.

5. Switch to a better loan

The home loan market is intensely competitive, which is why lenders often charge new borrowers lower interest rates than loyal customers. So you could be making big savings by refinancing to a lender offering a comparable loan at a lower rate. Try finding one with an offset account attached to the loan account. This is an effective tool to bring down the amount of interest you owe whilst providing you with available funds for any emergency that may arise.

In conclusion

Don’t give up. rising interest rates can be challenging. Talk to an expert lender if you need help understanding your options.

The expert lenders at The Hrkac Group are committed to helping borrowers get the most from their lending. Our in-house team of financial experts can help you create a financial plan that works for you and your individual circumstances, and can help you make the right decision about managing your home loan. If you want to discuss your options, speak to an expert Geelong Mortgage Broker at The Hrkac Group.

Our Geelong Mortgage Brokers’ expertise and experience in facilitating your home loan can help ensure a positive experience for you. To make an appointment to meet one of our friendly Geelong Mortgage Brokers today, feel free to contact us via email or phone (03) 5224 2366.

Liability limited by a scheme approved under Professional Standards Legislation.

At its July board meeting, the Reserve Bank of Australia (RBA) lifted the cash rate target by 50 basis points, in line with market expectations, bringing the official cash rate target to 1.35%. It also increased the interest rate on Exchange Settlement balances by 50 basis points to 1.25%.

This marks the third month in a row that the RBA has raised rates, with further increases expected over the course of this year as the central bank seeks to contain rising inflation. The third back-to-back rise follows an increase of 50 basis points in June – the largest increase since February 2002 – and 25 basis points in May. May’s increase was the first since 2010, as the central bank lifted the cash rate from its record low emergency level of 0.1%.

Global inflation is high

Global inflation is soaring. It is being boosted by COVID-19-related disruptions to supply chains, the war in Ukraine, and strong demand which is putting pressure on the capacity of production. Although monetary policy globally is responding to this higher inflation, it will be some time yet before inflation returns to target in most countries.

As part of the response, rate hikes are happening across the globe. The aim is to slow down economies and bring supply (production) and demand (spending) back into balance to address the soaring inflation rates. Nearly all central banks across the globe are lifting rates from ‘emergency’ levels to reflect more ‘usual’ functioning economies because of this.

In a statement from the RBA, Governor Philip Lowe had this to say on inflation in Australia:

“Inflation in Australia is also high, but not as high as it is in many other countries. Global factors account for much of the increase in inflation in Australia, but domestic factors are also playing a role. Strong demand, a tight labour market and capacity constraints in some sectors are contributing to the upward pressure on prices. The floods are also affecting some prices.

Inflation is forecast to peak later this year and then decline back towards the 2–3% range next year. As global supply-side problems continue to ease and commodity prices stabilise, even if at a high level, inflation is expected to moderate. Higher interest rates will also help establish a more sustainable balance between the demand for and the supply of goods and services. Medium-term inflation expectations remain well anchored and it is important that this remains the case. A full set of updated forecasts will be published next month following the release of the June quarter CPI.”

How COVID-19 and the war in Ukraine is driving inflation

An important factor to note in all of this is COVID-19. Workers are continuing to contract the virus and are forced to stay at home, resulting in fewer goods and services being produced. But economies are continuing to recover from the virus, with spending lifting. Unfortunately, spending is recovering more quickly than production. The other key factor is the war in Ukraine, driving up energy and food prices across the globe.

The Australian economy is resilient

In the statement from the RBA, Mr. Lowe commented on the Australian economy:

”The Australian economy remains resilient and the labour market is tighter than it has been for some time. The unemployment rate was steady at 3.9 % in May, the lowest rate in almost 50 years. Underemployment has also fallen significantly. Job vacancies and job ads are both at very high levels and a further decline in unemployment and underemployment is expected over the months ahead. The Bank’s business liaison program and business surveys continue to point to a lift in wages growth from the low rates of recent years as firms compete for staff in the tight labour market.

One source of ongoing uncertainty about the economic outlook is the behaviour of household spending. The recent spending data have been positive, although household budgets are under pressure from higher prices and higher interest rates. Housing prices have also declined in some markets over recent months after the large increases of recent years. The household saving rate remains higher than it was before the pandemic and many households have built up large financial buffers and are benefiting from stronger income growth. The Board will be paying close attention to these various influences on household spending as it assesses the appropriate setting of monetary policy.

The Board will also be paying close attention to the global outlook, which remains clouded by the war in Ukraine and its effect on the prices for energy and agricultural commodities. Real household incomes are under pressure in many economies and financial conditions are tightening, as central banks increase interest rates. There are also ongoing uncertainties related to COVID, especially in China.”

The Response

Central banks are ‘front loading’ rate hikes to try and get on top of inflationary pressures. That is, rates are being lifted more quickly and more aggressively than usual. The fear is that if higher rates of inflation take hold – become cemented in people’s consciousness – then it will take longer to bring the inflation rates back to preferred levels.

The risk with these ‘harder and faster’ rate increases is that they could cause economies to go into recession. Recessions are defined differently across the globe, but in Australia, the general definition of a recession is two consecutive quarters of economic contraction (declines in gross domestic product).

What this means for your mortgage

For a typical owner-occupier with a $500,000 mortgage and 25 years remaining, this increase will see their monthly repayments rise by $137, according to RateCity.

Their total increase to date from the May, June, and July rate hikes would be $333 per month.

For a borrower with a $1 million mortgage, today’s decision will add $273 to their monthly repayments, bringing their total increase to $665 per month since April.

CoreLogic figures also showed national house prices fell for the second consecutive month in June by 0.6 %.

In conclusion

From the statement from the RBA:

“Today’s increase in interest rates is a further step in the withdrawal of the extraordinary monetary support that was put in place to help insure the Australian economy against the worst possible effects of the pandemic. The resilience of the economy and the higher inflation mean that this extraordinary support is no longer needed. The Board expects to take further steps in the process of normalising monetary conditions in Australia over the months ahead. The size and timing of future interest rate increases will be guided by the incoming data and the Board’s assessment of the outlook for inflation and the labour market. The Board is committed to doing what is necessary to ensure that inflation in Australia returns to target over time.”

If you would like a free home loan review from our HG Mortgage broker team, download the below document and return it to us or email mortgages@hrkacgroup.com.au.

The information provided in this blog is of a general nature only and is not intended as either advice or recommendations and is not tailored to your specific circumstances. Please also note that this does include any information on any Payroll requirements imposed by any State or Territory Governments outside of the State of Victoria.

Liability limited by a scheme approved under Professional Standards Legislation.

A credit score is a number representing your financial history. It is calculated using the information in your credit report, which includes your payment history, the number and type of accounts you have, the amount of debt you have, as well as the length of your credit history. If you’re in the market for credit or a loan, it’s in your interest to boost your credit score as much as you can.

Credit scores are taken into consideration by potential lenders and creditors when determining whether or not to approve an applicant for credit. For example, if you’re applying for a home or business loan your mortgage broker may discuss your credit score with you. It can serve as an indication as to how likely you are to pay back the loan.

Your credit score will typically sit on a scale of zero to 1,000 or zero to 1,200, depending on the credit reporting agency. Higher credit scores demonstrate responsible past credit behaviour, which may instil more confidence in potential lenders and creditors when they are evaluating a request for credit. If you have a lower score, financial institutions will be less inclined to allow you to borrow large sums. If they do, your interest rates may be higher – as motivation to repay the loan sooner rather than later.

Here’s a general breakdown of credit score ranges from the three major credit agencies in Australia:

| Credit Score Range | Illion | Equifax | Experian |

| Excellent | 800 – 1000 | 833 – 1200 | 800 – 1000 |

| Very good | 700 – 799 | 726 – 832 | 700 – 799 |

| Average | 500 – 699 | 622 – 725 | 625 – 699 |

| Fair | 300 – 499 | 510 – 621 | 550 – 624 |

| Low | 0 – 299 | 0 – 509 | 0 – 549 |

It’s important to remember that everyone’s financial and credit situation is different, and there is no perfect score that will guarantee better loan rates and terms.

Now that we’ve established what credit scores are all about, here are 5 tips to keep front of mind if you want to boost your credit score and establish or maintain responsible credit behaviours:

1. Pay your bills on time, every time.

A record of consistent and punctual payments can contribute to a stronger credit score. This includes all your bills. Late or missed payments on credit cards, mobile phones, utilities, or your rent may be reported to credit agencies, which will likely negatively affect your credit scores. If you’re having trouble with paying a bill, contact the service provider immediately to ask about alternative arrangements or payment plans. Avoid skipping payments, even if you’re contesting a bill. Creating a monthly budget and scheduling automatic payments for bills and other repayments could help you avoid late or missed repayments.

2. Pay off your debts promptly.

Again, having evidence of prompt repayments will contribute to a strong credit score. On the other hand, making late payments can damage your credit. Although paying off a debt can initially cause scores to dip temporarily, in general you could see an improvement in your credit as soon as one or two months after you pay off the debt.

3. Keep your credit card balance below the limit.

A higher balance compared to your credit limit may negatively impact your credit score. Keeping your balance low with consistent and on-time repayments will look good on your credit report. Limit new applications for credit or loan products where you can and if appropriate, consider lowering the limit on any credit cards you have. This will put a firmer limit on the amount of debt you can accrue.

4. Apply for credit cautiously.

Applying for multiple credit accounts within a short period may have a negative effect on your credit score. Whether you are approved or not, your application for a new credit or loan products will be visible on your credit report. Multiple applications for credit within a short time can flag to lenders that you are under credit pressure.

5. Check your credit reports regularly.

It could be worth checking your credit report carefully to ensure all the information listed is accurate. If your credit report does contain incorrect information, it could be having a significant impact on your overall credit score. You’re entitled to a free copy of your credit reports every 12 months from each of the three nationwide credit agencies by visiting www.annualcreditreport.com. Checking your own credit reports won’t affect your credit scores.

By cross-referencing your credit report against bank statements and other financial documents, you may be able to spot inaccuracies on your credit report. In that case, you can contact the credit provider or the credit reporting body and ask them to amend your report. This could definitely help you boost your credit score.

If you’re interested in knowing more about credit scores, speak to the expert Geelong Mortgage Brokers at The Hrkac Group. when it comes to obtaining a home loan or business loan – whether it’s to purchase a home or refinance/consolidate your debts or purchase assets – the Geelong based brokerage team is there to help you with practical, effective financial advice.

We listen, we understand and we know what the best solution for your particular needs is. Our honest, knowledgeable Geelong Mortgage Brokers will give you the confidence to negotiate for your future so together, we can develop and maintain your wealth. Make an appointment today via contact us, or phone (03) 5221 2355.

If you want to break into the Geelong property market, you’ll likely find yourself in the market for a home loan. When searching for the ideal home loan for your needs, you have a few options available. You can do it yourself and visit the big four banks and various lenders in the hopes of discovering a deal that’s right for you. Or, you can engage the services of a local Geelong Mortgage Broker, who will do all of the groundwork for you.

To help you make a decision, we’ve created a list of 5 areas to compare the services of a Mortgage Broker against what you get from a bank.

1. Customer experience

When you visit a bank, you will only have their specific home loan options to choose from. They will explain their available products and recommend the one that most suits your needs. You will need to go through this process of talking through your options with multiple banks to make sure you are getting the best deal. If you decide on a home loan, the bank may put you in touch with a Lending Specialist to assist you with filling out your application.

When you choose to go through a Mortgage Broker, they will guide you through the entire process, start to finish. They can show you various options from lots of different banks and lenders, helping you compare rates, features and fees, all in one meeting. Your Mortgage Broker will ultimately connect you with a bank or non-bank mortgage lender and will be there to advise you through the application process.

2. Deal options

Banks can only offer you their own range of home loan products. The big four may have the largest range, with loans to suit most types of borrower, while smaller banks may have fewer options.

A Mortgage Broker has access to hundreds of loan products via their lending panel. This is a selection of 20-30 lenders, sometimes more, that the Mortgage Broker regularly does business with. They know all the ins and outs of each of these home loan products and can recommend the perfect one for you.

3. Advantages

Many banks, particularly the big four, have a large selection of home loan products. And they might employ Lending Specialists who can provide advice similar to a Mortgage Broker. But only for the range of home loans they offer. Banks can also offer you package deals on other financial products, like credit cards and savings accounts. But these bells & whistles may distract you from the prospect of a better deal out there for you.

With a Mortgage Broker, you receive knowledgeable advice and guidance from a professional who has tabs on a wide range of home loan offers. They can instantly compare rates from their full panel of lenders and assist you through the application process. They work for you and their service is usually free.

4. Disadvantages

Banks can only offer the limited home loan options they have available. They want you to sign up with them and understandably won’t tell you that there’s a similar or better product available somewhere else. They can’t offer independent advice and guidance.

With a Mortgage Broker, you will need to go through the application process twice; once with the Broker and once with the Lender, though they will guide you through both. And although their selection is much wider than a bank, a Mortgage Broker is limited to the lenders on their panel. It is also worth mentioning that while a Mortgage Broker works for you, their payment comes in the form of a commission from the lender you choose via their service.

5. Commissions and fees

Banks will typically charge an application or settlement fee, plus several other fees. Some banks charge more fees than others, and certain home loan products may have more fees than others available from the same bank.

Mortgage Brokers receive payment for their services through a commission from the lender you end up signing with. The majority don’t charge extra fees, there is no extra cost to you.

A Mortgage Broker can act as an intermediary between you and the bank. They research the hundreds of available home loans on the market so you don’t have to. They work directly with you to support you through the application and settlement process, helping you gain a full understanding of the paperwork and terms & conditions before signing on the dotted line.

If you’re in the market for a home loan, talk to our honest, knowledgeable Geelong Mortgage Brokers. The Hrkac Group Geelong Mortgage Brokers work with a large variety of lenders, both bank and non-bank, so we are able to ensure you are working with loan products that have all the features you need at a rate that works for you. We will work alongside you to guide you through your home loan application.

Make an appointment today via contact us, or phone 03 5224 2366.

When selecting a mortgage broker for your home loan, it’s critical to protect your interests by choosing the right one for your needs. If this is your first home purchase, this may be foreign territory. A mortgage broker should be able to guide you through the process, help you choose the right loan to finance your home, and facilitate the whole process. However, it’s essential you do your due diligence before choosing a mortgage broker.

Below we outline five key things you should take into consideration.

1. What are your available options?

Taking out a home loan is a big commitment, no question. You aren’t just going to go with the first result on a google search. Taking into account your financial situation, you need to carefully consider your available options to determine the type of loan you will need.

- How big is your deposit? The size of your initial deposit determines the type of home loan and interest rates you can qualify for. If your deposit is less than 20% of the purchase price of your prospective home, you will also have to pay Lender’s Mortgage Insurance.

- What loan features do you need? Do you require an offset account, extra repayments, or a redraw facility? Features such as these may save you money and provide flexibility.

- Fixed or variable interest rate? A fixed-rate home loan means your repayments will be the same for a set period; usually up to 5 years. This may help you with budgeting or save you from potential interest rises. Alternatively, a variable rate home loan is subject to the current interest rates in the market.

- Can you afford the monthly repayments? Take stock of your monthly finances. Go over all of your incomings and outgoings and be realistic about what you can afford.

2. Have you researched your broker?

Ask your mortgage broker about their qualifications and experience. Ideally, they will have many years of experience and a portfolio of satisfied customers. Make sure they are licensed to provide you with a loan. They should have their own Australian Credit Licence or be qualified to act as an authorised Credit Representative, as required by the Australian Securities and Investments Commission (ASIC). Some other accreditations to look out for include:

- Have a Certificate IV in Finance and Mortgage Broking

- Accredited under the National Consumer Protection Act

- A member of the Mortgage & Finance Association of Australia (MFAA) and/or the Finance Brokers Association of Australia (FBAA)

If any of your family or friends have recently gone through this process with a broker, you should ask them about their experience. Were they happy with their broker? What they would do differently next time? What are some things they would look for in their next broker?

3. Who is on your broker’s lending panel?

Brokers are restricted by a list of banks they can access loans from, this is known as their “lender panel”. A good broker will have a range of lenders on their panel and regularly engage the services of the full range, depending on the borrower’s circumstances.

Check if the broker has a range of reputable institutions. If not, you may miss out on better deals. Make sure your broker can explain how many lenders they have on their panel, how many they use, and why.

4. What are the fees, charges & commissions?

A broker is required by law to clearly explain and demonstrate how they are remunerated. Most brokers receive a percentage-based commission for their work, paid by the bank that is providing the loan. There is no cost to you.

5. Do you have a list of questions ready to go?

It’s always a good idea to have a list of questions for your broker handy to help you make your decision. Here’s a list to help you get started:

- What is your ownership structure? Ask your broker who owns them. Some are owned or part-owned by banks. Research shows that broker companies owned by big banks send more loans back to their parent company. A good broker won’t be influenced by their ownership structure and will recommend a wide range of loans from across the market.

- Can you provide a credit assessment? A broker is legally obliged to follow responsible lending laws and should never sell you an inappropriate loan. They must assess your income and expenses along with your financial objectives and expectations. This is all contained in a document called a credit assessment.

- Can you supply me with a credit guide? A broker is legally required to provide you with a credit guide. It encompasses the broker’s contact details and a record of the commission the broker will receive if you go ahead with the loan.

- How many lenders are on your panel? This will let you know how many loans a broker can look at for you – some have lots of options but others offer a surprisingly limited selection.

If a broker can’t answer basic questions about charges, commissions, and ownership structures, this could be a warning sign. A good broker should always be transparent about their business and services.

When it comes to obtaining a home loan the Geelong-based brokerage team at the Hrkac Group is there to help you with practical, effective financial advice.

We will help you find the best home loan solution for your particular needs. Our honest, knowledgeable mortgage brokers will give you the confidence to negotiate for your future so together, we can develop and maintain your wealth.

Make an appointment today via contact us, or phone 03 5224 2366.

First Home Loan Deposit Scheme

Purchasing your first home is a mix of making a daunting life decision and overwhelming excitement all at once. Even though you’re locking yourself in for a significant debt for the first time and you might be doubting your saving ability, there are many support systems in place to make the process of buying your first home easier.

The First Home Loan Deposit Scheme is a new initiative by the Australian Government and the National Housing Finances and Investment Corporation (NHIFC), where the Government will guarantee support for a percentage of your deposit.

Generally, you need to save a minimum of 20% of a home’s value as a deposit to avoid paying extra insurance and bank fees on your first home loan. Referred to as Lenders Mortgage Insurance, you’re basically paying the bank a fee to cover you for the amount you fall short on your deposit. With the new Deposit Scheme, the minimum deposit you’re required to pay, to avoid extra fees, is just 5%. If you can put forward 5% of your new home’s value, the Government and NHIFC will provide a guarantee to your bank for the remaining 15% (maximum).

This is not a cash payment or a deposit for your house, and there are no costs involved. What you get is support in the form of a guarantee from the Government to your bank, that you will be responsible for meeting all costs and repayments over the life of the loan. What’s even better, is this Scheme can be used in conjunction with other initiatives like the First Homeowners Grant (which exempts you from paying stamp duty on your first home).

As expected, there are rules for eligibility, which are outlined in great detail here. Some of them are:

- It must be your first home purchase

- You must be 18 years of age and an Australian Citizen

- You must be either single or in a de facto/married relationship

- You must earn under a certain amount ($125,000 for singles / combined $200,000 for couples)

- It must be your primary residence (investment properties are not covered)

- The property price must be under the price cap for its location (more information here).

- It must be a principle and interest loan

If you can tick off all of these criteria, then you are eligible to apply for a place in the scheme but be quick because there are limited places available in this financial year. The Deposit Scheme is only offered in partnership with certain lenders though, so it’s best to talk to your lending specialist to reserve your position in the Scheme before they run out. There will be more places released after July 2020.

Get in touch with Paul Duncan, Geelong’s Lending Specialist to talk about securing your place in the First Home Loan Deposit Scheme today. Contact us to make an appointment, or phone 03 5224 2366.

Information is intended to be of a general nature only and any advice has been prepared without taking into account any person’s particular objectives, financial situation or needs</em