With the state of the world’s economies, persistently high and rising inflation, and so much uncertainty, homeowners are bracing themselves for even more rate hikes from the Reserve Bank of Australia (RBA). This is impacting Australians in all aspects of their spending, and even though housing prices are reported to be declining, homeowners are still being forced to borrow more and more to enter the market.

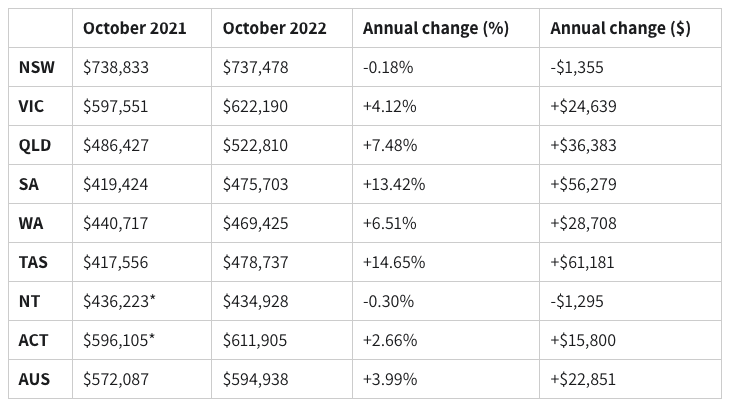

The latest lending indicators from the Australian Bureau of Statistics (ABS), in the table below, show that the average mortgage size (for owner-occupier dwellings) was $594,938 in October 2022 — up from $572,087 in October 2021.

Although the average Australian home loan has only increased by $22,851 this is after the impact of surging property prices that was witnessed across the country over the pandemic. According to property research firm CoreLogic, Australian housing values increased 28.6% over the latest upswing, which equates to an average increase of $170,700.

Lenders are feeling the burden of increasing interest rates, rising inflation, and increases in loan repayments.

The current trend of the Australian property market is being driven by how the rate hikes have affected affordability. There has been a decrease in demand for purchasing homes and an increase in home listings. With a shift in demand towards cheaper and more affordable homes like units. This is likely to continue driving growth in the unit sector while the housing market is levelling off.

As a first home buyer, most of the average loan values listed above are still below the state and territory property price caps for the First Home Loan Deposit Scheme and New Home Guarantee initiatives. These schemes allow eligible first home buyers to purchase a home with as little as 5% deposit without paying Lenders Mortgage Insurance, which on average helps people purchase their first home 4 years sooner. So taking advantage of these schemes is a great tool helping you get into the market sooner before prices and the amount you need to borrow rises.

Amid the confusion of interest rates, inflation, property prices stabilising, many are wondering if now is the time to buy. If you got one lesson out of the pandemic, it should have been buy and buy now. During the early stages of the pandemic, many people held back from buying with so much uncertainty and fears of a property price crash. However, the opposite occurred and prices soared, leaving those who were just watching in the dust. Instead of trying to time the market perfectly, you should aim to buy as soon as you have a deposit and your finances in order. The sooner you get into the market, the more time you will have to benefit from your property’s growth.

The expertise and experience of our Geelong Mortgage Broking team at The Hrkac Group can help you in the process of obtaining a home loan, refinancing your current loan, or to discuss the finance of an investment property, whatever your personal circumstances. To make an appointment to meet with one of our friendly Mortgage Brokers today, feel free to contact us via email or phone (03) 5224 2366.

The information provided in this blog is of a general nature only and is not intended as either advice or recommendations and is not tailored to your specific circumstances. Please also note that this does include any information on any Payroll requirements imposed by any State or Territory Governments outside of the State of Victoria. Please contact our partner – SIBS Bookkeeping team or us – the Hrkac Group Accountants team – if you would assistance as to how, or if, any of the abovementioned would apply to you.

Liability limited by a scheme approved under Professional Standards Legislation.