Borrowing on the rise as home loans are up on average $170,000 over the latest upswing

With the state of the world’s economies, persistently high and rising inflation, and so much uncertainty, homeowners are bracing themselves for even more rate hikes from the Reserve Bank of Australia (RBA). This is impacting Australians in all aspects of their spending, and even though housing prices are reported to be declining, homeowners are still being forced to borrow more and more to enter the market.

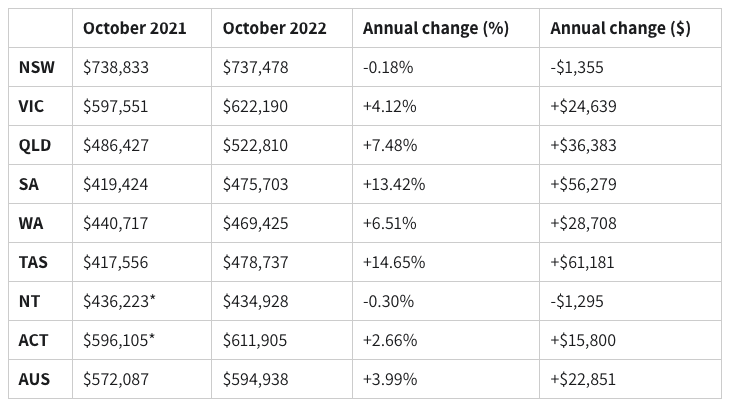

The latest lending indicators from the Australian Bureau of Statistics (ABS), in the table below, show that the average mortgage size (for owner-occupier dwellings) was $594,938 in October 2022 — up from $572,087 in October 2021.

Although the average Australian home loan has only increased by $22,851 this is after the impact of surging property prices that was witnessed across the country over the pandemic. According to property research firm CoreLogic, Australian housing values increased 28.6% over the latest upswing, which equates to an average increase of $170,700.

Lenders are feeling the burden of increasing interest rates, rising inflation, and increases in loan repayments.

Average loan size by state and territory — October 2021-22 (Source: ABS)

Where is the market headed?

The current trend of the Australian property market is being driven by how the rate hikes have affected affordability. There has been a decrease in demand for purchasing homes and an increase in home listings. With a shift in demand towards cheaper and more affordable homes like units. This is likely to continue driving growth in the unit sector while the housing market is levelling off.

As a first home buyer, most of the average loan values listed above are still below the state and territory property price caps for the First Home Loan Deposit Scheme and New Home Guarantee initiatives. These schemes allow eligible first home buyers to purchase a home with as little as 5% deposit without paying Lenders Mortgage Insurance, which on average helps people purchase their first home 4 years sooner. So taking advantage of these schemes is a great tool helping you get into the market sooner before prices and the amount you need to borrow rises.

No one gets ahead by waiting

Amid the confusion of interest rates, inflation, property prices stabilising, many are wondering if now is the time to buy. If you got one lesson out of the pandemic, it should have been buy and buy now. During the early stages of the pandemic, many people held back from buying with so much uncertainty and fears of a property price crash. However, the opposite occurred and prices soared, leaving those who were just watching in the dust. Instead of trying to time the market perfectly, you should aim to buy as soon as you have a deposit and your finances in order. The sooner you get into the market, the more time you will have to benefit from your property’s growth.

The expertise and experience of our Geelong Mortgage Broking team at The Hrkac Group can help you in the process of obtaining a home loan, refinancing your current loan, or to discuss the finance of an investment property, whatever your personal circumstances. To make an appointment to meet with one of our friendly Mortgage Brokers today, feel free to contact us via email or phone (03) 5224 2366.

The information provided in this blog is of a general nature only and is not intended as either advice or recommendations and is not tailored to your specific circumstances. Please also note that this does include any information on any Payroll requirements imposed by any State or Territory Governments outside of the State of Victoria. Please contact our partner – SIBS Bookkeeping team or us – the Hrkac Group Accountants team – if you would assistance as to how, or if, any of the abovementioned would apply to you.

Liability limited by a scheme approved under Professional Standards Legislation.

It was announced in the 2019–20 Budget that the government would be expanding on Single Touch Payroll (STP) to require additional information. Known as Single Touch Payroll Phase 2, the mandatory start date of this new process was the 1st of January 2022.

This expansion was meant to streamline reporting for employers who are required to report information on their employees to multiple government agencies. It will also make it easier for customers of Services Australia to receive the correct payments on time.

As we near the end of the first year of Phase 2 reporting, it becomes more important to make sure you are reporting correctly. Penalties for reporting mistakes will start to be enforced after 31st December 2022.

Although users of some types of software, in particular Xero, have a blanket extension from the ATO until the 31st March 2023 to report their first STP Phase 2 pay run.

Our knowledgeable Geelong Accountants have put together some information on the Single Touch Payroll Phase 2 expansion, to serve as a helpful guide for you to reference at any time.

1. What do I need to do to prepare for STP Phase 2?

The first thing you should do as a business is to acquaint yourself with Single Touch Payroll Phase 2 and how it impacts your reporting requirements.

Preparation is key. A comprehensive dialog with business leaders, advisors, and employees to determine your individual organisation’s requirements. Then you can formulate and implement a plan ahead of the compliance deadline.

Ensure that your payroll software is up to date. Software providers have updated their payroll solutions to accommodate these changes, allowing your businesses to provide the newly required information.

2. What are the key changes?

The way you submit your Single Touch Payroll report, the due date, and the end-of-year finalisation declaration for each employee have not changed. Tax and superannuation details are still required as before.

While the first installment of Single Touch Payroll was introduced to reduce reporting requirements and allow Australian businesses to digitally engage with Government agencies in a single process, Phase 2 does require businesses to undertake additional reporting. The changes will be an adjustment for many.

STP Phase 2 aims to streamline your reporting process by including information that you currently provide in different ways and on different forms all in one place in your STP report. This brings with it changes that reduce reporting requirements in some areas and require additional reporting in others. The following areas reflect these changes:

Tax File Number Declarations

The details collected from Tax File Number declarations – including Tax File Number, employment type, and higher education debts — are to be included in STP reporting, so the declaration itself is no longer required to be sent to the ATO.

Employee Separation Certificates

Employee Separation Certificates are no longer necessary, as information about why an employee has left the business will now be provided via STP reporting.

Lump Sum E payments

Before, if an employer paid an employee a payment owing from a previous year, a Lump Sum E letter had to be provided to the employee. The letter is no longer required as this information is now to be included in STP reporting, with details of the payment to appear in the income statement of the employee.

Child Support

There is now the option to include child support garnishees and deductions in STP reporting, reducing the need to provide documentation to the Child Support Registrar.

Employment Type

Optional prior to the introduction of STP Phase 2, reporting of employment type is compulsory under the new way of reporting. Businesses must declare whether their employees are full-time, part-time, or casual, in addition to new categories such as labour hire or volunteer.

Disaggregation of Gross

Income must now be itemised by each of its components, including salary sacrifice, overtime, paid leave, bonuses, commissions, director’s fees, and allowances (allowances must also be individually itemised) rather than reported as a gross sum.

Country Codes

If you have Australian resident employees working overseas, businesses will need to provide details of the host country, in the form of a Country Code.

Reporting previous Business Management Software IDs and Payroll IDs

You can now provide the ATO with previous Business Management Software IDs and Payroll IDs in your STP report. If you’ve changed your business structure or changed payroll software and you’re having trouble with finalising previous records, providing this information can help reduce and fix issues with employees’ duplicate income statements in ATO online services. This is voluntary and not all software platforms will offer this functionality.

3. Benefits of STP Phase 2

Benefits for employers

Single Touch Payroll Phase 2 information is intended to streamline employer interactions. You’ll no longer have to send the ATO your employees’ tax file number (TFN) declarations, Employee Separation Certificates or provide your employees with Lump Sum E letters, as your requirements for these are met all in one place, in your STPP2 reporting. If you were using a concessional reporting option, such as for closely held payees or for inbound assignees, you can now meet your requirements, again all in one place, by reporting on income types in your STPP2. You can also voluntarily report child support deductions or garnishees (or both) through STPP2 reducing the need to send separate advice to the Child Support Registrar.

Payroll information is shared in near real-time with Services Australia, making it easier to provide or confirm employment and payroll information about your employees, and for your employees to provide employment and payroll information such as pay slips for prior periods.

Benefits for employees

The ATO will have better visibility of the types of income employees have received at tax time, allowing their details to be more accurately pre-filled on their individual income tax returns. The new information reported will allow the ATO to prompt employees to make changes if they’ve provided their employers with incorrect information so they can avoid getting a tax bill.

4. Are there penalties for STP non-compliance?

The introduction to STP Phase 2 came with a grace period for reporting mistakes, which is scheduled to finish on December 31st, 2022. As mentioned earlier, this excludes users of some types of software, in particular Xero, who have a blanket extension from the ATO until the 31st of March 2023 to report their first STP Phase 2 pay run.

For more information on popular software solutions Xero and MYOB, see these links:

https://www.xero.com/au/programme/single-touch-payroll/stp-2/

https://help.myob.com/wiki/display/myob/Getting+ready+for+STP+Phase+2

Under STP, the penalty for late or missed reporting is $210 days for every 28 days your report is overdue to a maximum of $1,050 for small businesses, $2,100 for medium entities, $5,250 for large entities, and $525,000 for global entities.

In conclusion

Changes in reporting requirements can be daunting, but our expert Geelong Accountants at The Hrkac Group are committed to providing you with sound business advice and updates. If you want to grow your wealth, improve cash flow, and minimise your tax, talk to our professional, approachable, and proactive Business Accountants at The Hrkac Group.

The expertise and experience of our Geelong Accounting team can help ensure the success of your business. To make an appointment to meet with one of our friendly Accountants today, feel free to contact us via email or phone at (03) 5224 2366.

The information provided in this blog is of a general nature only and is not intended as either advice or recommendations and is not tailored to your specific circumstances. Please also note that this does include any information on any Payroll requirements imposed by any State or Territory Governments outside of the State of Victoria. Please contact our partner – SIBS Bookkeeping team or us – the Hrkac Group Accountants team – if you would assistance as to how, or if, any of the abovementioned would apply to you.

Liability is limited by a scheme approved under Professional Standards Legislation.

Did you know?

By 1895 each Australian State had introduced its own inheritance (estate) tax. This tax was also often referred to as “death duties”.

Federal estate tax was introduced in 1914 but was abolished 65 years later, in 1979.

The States have also abolished their inheritance taxes, starting with Queensland in 1978. By 1982, all States had abolished their state-based death duties.

Death Duties today

While it is true Australia no longer has an inheritance tax or death duties in the strict sense of the word, there are some taxes that may become payable on a person’s death.

Capital gains tax

While death itself will generally not trigger a liability to pay capital gains tax, when certain assets are sold by a person’s estate or by beneficiaries that inherit those assets, the disposal may result in capital gains tax becoming payable.

The rules governing capital gains tax are complex and will depend on the nature of the assets (e.g. shares, investment properties, former main residence). In some circumstances, the sale of an asset may be exempt from capital gains tax (such as the sale of a former main residence that is sold within two years of death).

When dealing with a deceased estate, guidance from a suitably qualified accountant or tax agent is recommended to ensure liability for tax is managed appropriately.

Superannuation

Another significant area of inheritance tax “by stealth” is a deceased person’s superannuation benefits.

Superannuation held by a person at the time of their death may include benefits in the accumulation phase, the pension phase, or a combination of both.

Superannuation benefits may be minimal – perhaps a few thousand dollars or they may be significant – potentially hundreds of thousands or even millions of dollars.

When a member of a superannuation fund passes away, their superannuation savings must be cashed “as soon as practicable” following death. While “as soon as practicable” is not specifically defined in legislation, it is generally expected superannuation death benefit should be paid within six months of a person’s death. However, this may not always be possible, particularly where a dispute occurs, there is difficulty in locating potential beneficiaries, or where superannuation assets cannot be readily sold.

Superannuation death benefits can be cashed in two ways:

- Payment of a pension to certain eligible beneficiaries – generally to a surviving spouse; and/or

- Payment of a lump sum to nominated beneficiaries or to the estate of the deceased.

Superannuation law imposes restrictions on the classes of beneficiaries that can receive a death benefit directly from a superannuation fund, either in the form of a pension paid on the death of a member or as a lump sum. Often superannuation funds will pay a member’s death benefit to their legal personal representative to be dealt with as part of their estate.

Death benefits are also not just governed by superannuation law. They are also impacted by taxation law.

A superannuation death benefit paid as a lump sum is tax-free when paid to a “dependant” (as defined in tax law). Where the death benefit is paid to the estate of the deceased, a “look through” is applied to determine who the eventual beneficiary of the superannuation death benefit will be. If the ultimate beneficiary is a “tax dependant”, the benefit is tax-free.

A tax dependant includes:

- The spouse, or former spouse of the deceased,

- The deceased’s children under 18 years of age,

- Anyone with whom the deceased had an interdependency relationship just before they died, or

- Any other person who was financially dependent on the deceased at the time of their death.

In general terms, parents, brothers, and sisters, adult children, and grandchildren of a deceased person are unlikely to be a tax dependent of the deceased. Financial dependency can be difficult to determine.

When a superannuation benefit is paid to a person other than a tax dependent, we need to determine the components of a deceased member’s death benefit. This information can be obtained from the deceased’s superannuation fund.

Tax components may include one or more of the following:

- Tax-free component

- Taxable component – taxed element

- Taxable component – untaxed element

The tax-free component generally comprises contributions made to superannuation for which a tax deduction has not been claimed. This includes non-concessional contributions and downsizer contributions.

The taxable component – taxed element will comprise tax-deductible contributions (including those made by employers and personal tax-deductible contributions) and investment earnings on contributions.

A taxable contribution – untaxed element will include certain contributions made to an untaxed superannuation fund – generally older style funds for public servants. Life insurance proceeds paid to a deceased member’s account following the member’s death may also give rise to an untaxed element.

When a death benefit is paid, the components are taxed in the following manner:

- Tax-free component – is exempt from tax

- Taxable component – taxed element – taxed at 15%

- Taxable component – untaxed element – taxed at 30%

If a superannuation fund pays a death benefit directly to a beneficiary, rather than to the estate, Medicare Levy (2%) is added to the tax rates mentioned above.

Should I withdraw my super?

One of the questions often asked by seniors, particularly when it is likely their super will pass to non-tax dependants such as adult children, is whether super should be withdrawn as a lump sum while they are still living.

Remember, the tax-free component and taxable component – taxed element withdrawn as a lump sum by a member aged 60 or older, who is still living, is exempt from tax.

The answer to this question is – it depends!

For example, if a member’s superannuation balance is comprised entirely or has a significant portion of tax-free component, the tax payable on death will be minimal, if any.

However, if the benefit includes a significant portion of the taxable component, then the progressive drawing down of super as a person ages, may be worth considering.

Of course, if superannuation is withdrawn and invested outside of the superannuation system, income earned on the investments, and capital gains, will be taxable.

At the end of the day, managing superannuation in our maturing years will depend on several factors including:

- Who is the likely beneficiary – a tax dependent or a non-tax dependent?

- What are the components of the superannuation benefit – tax-free, taxable, or a combination?

- What tax is likely to be payable if superannuation is withdrawn and is invested outside the superannuation system?

- What is the member’s current health status and longevity outlook?

Unfortunately, there is no simple answer to avoiding tax payable on superannuation death benefits however there are strategies that can be drawn upon to minimise tax.

As every person’s situation will be different, seeking appropriate advice from a licensed financial adviser is recommended.

The content within this blog has been sourced from our Licensee, Alliance Wealth’s blog ‘Realise Your Dream’.

https://blog.centrepointalliance.com.au/realiseyourdream/australias-secret-inheritance-tax

General Advice Warning

This information has been provided as general advice. We have not considered your financial circumstances, needs, or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication. Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

Liability limited by a scheme approved under Professional Standards Legislation.

If you have a home loan, or are in the market to buy a house, you are most certainly aware by now that interest rates are rising at a rapid rate. The Reserve Bank has this month raised the cash rate by 0.5 of a percentage point for the fourth straight month in a row, and governor Philip Lowe has said the board expects to increase interest rates even further over the months ahead. The cash rate target of 2.35 per cent is the highest since the beginning of 2015. As a result, home loan rates are also certain to rise.

Governor Lowe’s post-meeting statement once again reiterated that the bank’s board is “committed to doing what is necessary” to bring inflation back within the bank’s 2-3 per cent target range “over time”. Analysis by RateCity suggests that this most recent increase will add an extra $200+ per month to repayments on a $750,000 mortgage. The total increase in monthly repayments on a $750,000 mortgage since the RBA began lifting the cash rate from its all-time low of 0.1 per cent in May, will be over $900.

These rises aren’t unprecedented; in 1994, the cash rate went from 4.75 per cent to 7.5 per cent in just five months. All the same, things may be feeling a bit scary in your household right now. So what should you do in response? Here are five suggestions:

1. Don’t panic

Don’t panic, there are many ways to survive and thrive in these challenging times. Your lender wouldn’t have approved your mortgage unless they were sure that you could cope with a worst-case-scenario series of rate rises. So unless your financial position has severely deteriorated since then, you should be able to cope with higher repayments. While a higher mortgage repayment may strain your budget and certainly cause concern, it’s most likely never going to get to the point where you must default on your mortgage. Soaring rates, increasing inflation, and oil price hikes are all part of the economy. There are things you can do to prepare for rate rises and keep your finances on track.

It may help to understand exactly how the rate increases will impact your bottom line. If you have a financial planner, mortgage broker or someone who can assist you in these matters, book in a catch up. By understanding how much more money you need to find each month, you can start to make the proper arrangements. Stay positive and don’t despair. Rising interest rates can be challenging. Talk to one of our expert lenders if you need help understanding your options.

2. Get ahead of any problems

If you think you might struggle to continue making your repayments, contact your lender now to discuss your options. It’s important you make contact before you miss a repayment, not after, because the more warning you give your lender, the more flexible they’re likely to be. No one wants you to default on your loan. Understand your options. If you’re struggling to make ends meet, there are other avenues you can take.

When speaking to your lender about your circumstances, see if they have available options to defer, pause or reduce your repayments if you are suffering from financial hardship. Many lenders in Australia offer a hardship policy, and you should speak to them if you feel the situation is becoming too difficult for you to manage.

3. Budget for rate rises

Make a budget and commit to it. This will help you stay across your finances and ensure you’re not overspending. Understanding where your money goes is important for anyone, under pressure from rate rises or not. If you don’t already have one, create a budget that encompasses all of your income and all of your expenses. Make sure that you capture everything, including major expenses (such as loan repayments, bills, groceries, and fuel) and also smaller expenses and luxuries, (like take-away, streaming services, etc.). Once you have an idea of your actual cash flow, you can start to make more informed decisions about your spending.

If rates increase, you must find the increased repayment in the budget somewhere. Assume your mortgage rate will rise by 2 percentage points. Calculate what your new monthly repayment would be and start paying it now. You can put the extra money into an offset account, a redraw facility or a special savings account. If you have a variable home loan, an offset account can be a useful tool. You can still use it as a regular transaction account but, just by having the money sitting there, it reduces how much interest you’re paying on your loan.

4. Improve your savings rate

Finding crafty ways to reduce your expenses could give you a bit more breathing room as rates rise. When times become a little tougher, it’s always good to look at where your money is going and try to reduce your habit-spending where possible. We tend to overlook smaller purchases, like your daily take-away coffee, that bottle of wine with dinner, or other minor impulse purchases. Perhaps you could skip dining out every couple of weeks, cancel your weekly meal box or reassess some of the household brands you buy. Reducing your overall spending is the main objective if you find yourself needing to free up some extra cash to make way for increased repayments.

Now could also be a great time to ask for a raise or a promotion. Employees are in a unique position to ask for a raise this year, because high inflation and tight labour markets are expected to continue. Additionally, you could look for new income opportunities on the side.

5. Switch to a better loan

The home loan market is intensely competitive, which is why lenders often charge new borrowers lower interest rates than loyal customers. So you could be making big savings by refinancing to a lender offering a comparable loan at a lower rate. Try finding one with an offset account attached to the loan account. This is an effective tool to bring down the amount of interest you owe whilst providing you with available funds for any emergency that may arise.

In conclusion

Don’t give up. rising interest rates can be challenging. Talk to an expert lender if you need help understanding your options.

The expert lenders at The Hrkac Group are committed to helping borrowers get the most from their lending. Our in-house team of financial experts can help you create a financial plan that works for you and your individual circumstances, and can help you make the right decision about managing your home loan. If you want to discuss your options, speak to an expert Geelong Mortgage Broker at The Hrkac Group.

Our Geelong Mortgage Brokers’ expertise and experience in facilitating your home loan can help ensure a positive experience for you. To make an appointment to meet one of our friendly Geelong Mortgage Brokers today, feel free to contact us via email or phone (03) 5224 2366.

Liability limited by a scheme approved under Professional Standards Legislation.

Deceased Estates encompass all of the property and belongings that hold monetary value, owned in the sole name of a person who has died. Most people are familiar with the concept of deceased estates as containing valuable items to be distributed to beneficiaries. It is perhaps less well understood that when someone dies, the debts and liabilities that they held during life often continue and must be discharged out of the estate. In this post, we will outline the general rules of deceased estates and what is and is not included.

When a person dies, everything they solely own forms their estate. This may include:

- Real estate

- Vehicles

- Money in the bank

- Investments

- Insurance policies

- Stocks and shares

- Household items

- Jewellery

- Domestic pets, which are treated as property for the purposes of distribution of the estate.

- Any other possessions.

Some types of income can also form part of the deceased estate. However, some assets will not be included because the deceased may have made other arrangements to distribute them. For example, assets that are jointly owned are not part of the estate and will pass to the surviving owner.

Who Is Responsible For Administering Deceased Estates?

Deceased estates hold the assets of the deceased in trust, from the time of the death of the person concerned, until the transfer of the property and/or assets to their beneficiaries as nominated in their Will.

It is administered by either:

- An executor appointed in the person’s will, or

- An administrator appointed by the Supreme Court.

If there is a valid Will, the person named as Executor in the Will is responsible for the distribution of the deceased estate according to the testamentary wishes as expressed in the Will.

A Grant of Probate is required before an Executor can administer a person’s estate and distribute the assets to the beneficiaries. This means the Supreme Court of Victoria issues/grants a document confirming that the will is valid. It also confirms the appointment of the executor. It’s officially called a grant of representation. There are two types of these grants:

- Probate – where there is a will

- Letters of administration – where there is an informal Will (not properly executed or drafted)

- Intestacy – where there is no Will.

A grant of representation gives a person the legal right to administer the estate of the deceased. Some small estates (valued at less than $50,000.00 gross value) may not need a grant of representation.

After probate the executor collects all of the deceased’s probate assets, settles their debts, and ensures that the remaining assets are distributed to the nominated beneficiaries.

If someone dies without a valid will, they are said to die intestate, and the result is a more complicated process of having the estate distributed according to the law in accordance with the Administration and Probate Act 1958. Without a nominated executor in a will, the deceased is not able to decide who will take responsibility for administering their deceased estate, it is usually the next-of-kind who will need to apply for a grant of representation, or if no next-of-kin, the person who is next entitled to benefit from the estate in accordance with the legislation.

Responsibilities of an Executor

Administering an estate involves finalising everything relating to the assets of the deceased person’s estate.

This includes managing all the financial and legal issues, closing bank accounts, selling/transferring shares, dealing with the Superannuation benefits, and making sure all debts are paid and assets accounted for. It also means being responsible for making sure the beneficiaries named in the Will receive their inheritance. The Executor or Administrator (this information applies equally to both) is responsible for administering the deceased estate in the best interest of the beneficiaries nominated in the Will (or if no will exists, the deceased person’s next of kin or another person according to a state or territory law).

Tasks usually performed by an executor may include:

- Locating the original or a copy of the Will

- Arranging the funeral

- Obtaining a death certificate

- Applying for Probate

- informing investment bodies of the death – these might include banks, building societies, and share registries and furnishing them with a certified copy of the Death Certificate

- informing Centrelink and other government bodies, such as the Tax Office

- locating assets and having their market value assessed by either a Real Estate Agent (x3) or a private valuer;

- paying debts, income tax, and funeral expenses

- transferring assets and paying stamp duty (if applicable)

- distributing the surplus to beneficiaries.

Tax responsibilities

If you have been appointed as an Executor or Administrator of the deceased estate, you will also be responsible for managing the deceased estate’s tax affairs. This includes:

- lodging a final return, and any outstanding prior-year returns, for the deceased person

- lodging any trust tax returns for the deceased estate

- providing beneficiaries with the information they need to include distributions in their own returns and, in certain cases, paying tax on their behalf.

There are generally no death duties in Australia. However, tax may be payable on certain income or capital transactions that arise as a consequence of a person’s death.

Any tax liability that may be generated from your role as Executor is separate from your own personal tax liability. Therefore don’t include any of the income of the deceased person or deceased estate in your own personal tax return (except for any trust income you may receive as a beneficiary).

Another item that may potentially have to be declared is any fee charged to the estate for executor services performed.

Capital gains tax implications

When the assets of a deceased estate are distributed, a special rule applies that allows any capital gain or loss made on a CGT asset to be disregarded if the asset passes:

- to the executor

- to a beneficiary, or

- from the executor to a beneficiary.

However, if an Executor sells an asset of the deceased estate after two years after the date of death and then distributes the proceeds to the beneficiaries, the sale is subject to CGT applies and only a partial exemption to CGT may apply.

In most cases, the transfer of CGT assets into a deceased estate and then out to their beneficiaries will not incur an income tax liability.

Superannuation death benefits

In most cases, when a person dies, their superannuation fund will pay their remaining super to their nominated beneficiary, which is called a Superannuation Death Benefit.

If there are no binding death nominations, then the Trustee of the super fund will decide how the benefit will be paid. Depending upon the trust deed of the superannuation fund, and rules and regulations operating for superannuation, the trustee may pay it to the deceased estate, and it will be distributed in accordance with the terms of the Will.

If you are a dependant of the deceased, you do not need to pay tax on any component of a superannuation death benefit if you receive it as a lump sum (if you receive it as an income stream you may need to pay tax on it). Also do not include it on your tax return as income.

If you are not a dependant and you receive a death benefit it must be as a lump sum. The item is generally taxable as follows:

- Taxed element of the benefit: 15% plus Medicare levy

- Untaxed element of the benefit: 30% plus Medicare levy

Which debts are paid from a Deceased Estate?

A Will should also make provision for the executors to pay for expenses such as the funeral, and to discharge any debts out of the deceased estate. An Executor will also ensure that any applicable income tax is paid from the deceased estate. The estate must pay any other tax that falls due as a result of the liquidation of assets, such as superannuation payouts and capital gains on the sale of investments such as shares or property.

Generally, an Executor will pay the debts of the deceased before any assets are distributed to beneficiaries. The only exception is that the superannuation death benefits and life insurance of the deceased cannot be used to repay the debts of the deceased estate. All other assets of the deceased estate are available to the Executor for the purpose of discharging debts, regardless of the instructions of the will as to the distribution of assets. Therefore an executor is unable to, for example, distribute a mortgage-free property to a beneficiary if there are other debts in the estate that cannot be discharged without the sale of the property.

What happens if any debts cannot be settled?

If the estate does not contain enough assets to cover the debts at the time of death, the Executor will pay the debts according to either bankruptcy provisions or the insolvent estate provisions. An Executor is not required to repay the debts out of their own pocket unless they have some direct involvement with that debt (i.e. the debt is secured against a property that they own or, they have personally guaranteed the debt).

Bankruptcy and insolvency estate provisions ensure that the first priority is the funeral, testamentary, and administration expenses. The Executor will then discharge current and past tax debts, regardless of any instructions that the deceased has left in the Will, followed by the repayment of secured debts such as home or car loans. The deceased estate will also prioritise the payment of any delinquent child support and make provision for the ongoing payment of child support for a dependent child (if applicable). If there is a HECS-HELP education debt outstanding at the time of death, the balance of the debt will be extinguished.

The final debts to be paid out of a deceased estate are unsecured debts, and it is this class of debts that are most likely to remain unpaid if the estate is insolvent. This means that even if a Will makes a provision, for example, that an unsecured debt to a family member is to be repaid, this debt will be paid only after all secured debts are discharged. This can be an issue where family members have provided substantial unsecured loans towards the purchase of a home or investment in a business. This is one of many reasons that family loans should always be formalised and documented.

If you’re interested in knowing more about Deceased Estates, speak to the expert Geelong lawyers at The Hrkac Group. Making sure that everything runs as smoothly as possible depends on all legal and financial obligations being met, and that can require liaison between a number of different parties.

Our Geelong Lawyers’ expertise and experience in facilitating Deceased Estates can help ensure a positive experience for you. To make an appointment to meet one of our friendly Geelong Lawyers today, feel free to contact us via email or phone (03) 5224 2366.

At its July board meeting, the Reserve Bank of Australia (RBA) lifted the cash rate target by 50 basis points, in line with market expectations, bringing the official cash rate target to 1.35%. It also increased the interest rate on Exchange Settlement balances by 50 basis points to 1.25%.

This marks the third month in a row that the RBA has raised rates, with further increases expected over the course of this year as the central bank seeks to contain rising inflation. The third back-to-back rise follows an increase of 50 basis points in June – the largest increase since February 2002 – and 25 basis points in May. May’s increase was the first since 2010, as the central bank lifted the cash rate from its record low emergency level of 0.1%.

Global inflation is high

Global inflation is soaring. It is being boosted by COVID-19-related disruptions to supply chains, the war in Ukraine, and strong demand which is putting pressure on the capacity of production. Although monetary policy globally is responding to this higher inflation, it will be some time yet before inflation returns to target in most countries.

As part of the response, rate hikes are happening across the globe. The aim is to slow down economies and bring supply (production) and demand (spending) back into balance to address the soaring inflation rates. Nearly all central banks across the globe are lifting rates from ‘emergency’ levels to reflect more ‘usual’ functioning economies because of this.

In a statement from the RBA, Governor Philip Lowe had this to say on inflation in Australia:

“Inflation in Australia is also high, but not as high as it is in many other countries. Global factors account for much of the increase in inflation in Australia, but domestic factors are also playing a role. Strong demand, a tight labour market and capacity constraints in some sectors are contributing to the upward pressure on prices. The floods are also affecting some prices.

Inflation is forecast to peak later this year and then decline back towards the 2–3% range next year. As global supply-side problems continue to ease and commodity prices stabilise, even if at a high level, inflation is expected to moderate. Higher interest rates will also help establish a more sustainable balance between the demand for and the supply of goods and services. Medium-term inflation expectations remain well anchored and it is important that this remains the case. A full set of updated forecasts will be published next month following the release of the June quarter CPI.”

How COVID-19 and the war in Ukraine is driving inflation

An important factor to note in all of this is COVID-19. Workers are continuing to contract the virus and are forced to stay at home, resulting in fewer goods and services being produced. But economies are continuing to recover from the virus, with spending lifting. Unfortunately, spending is recovering more quickly than production. The other key factor is the war in Ukraine, driving up energy and food prices across the globe.

The Australian economy is resilient

In the statement from the RBA, Mr. Lowe commented on the Australian economy:

”The Australian economy remains resilient and the labour market is tighter than it has been for some time. The unemployment rate was steady at 3.9 % in May, the lowest rate in almost 50 years. Underemployment has also fallen significantly. Job vacancies and job ads are both at very high levels and a further decline in unemployment and underemployment is expected over the months ahead. The Bank’s business liaison program and business surveys continue to point to a lift in wages growth from the low rates of recent years as firms compete for staff in the tight labour market.

One source of ongoing uncertainty about the economic outlook is the behaviour of household spending. The recent spending data have been positive, although household budgets are under pressure from higher prices and higher interest rates. Housing prices have also declined in some markets over recent months after the large increases of recent years. The household saving rate remains higher than it was before the pandemic and many households have built up large financial buffers and are benefiting from stronger income growth. The Board will be paying close attention to these various influences on household spending as it assesses the appropriate setting of monetary policy.

The Board will also be paying close attention to the global outlook, which remains clouded by the war in Ukraine and its effect on the prices for energy and agricultural commodities. Real household incomes are under pressure in many economies and financial conditions are tightening, as central banks increase interest rates. There are also ongoing uncertainties related to COVID, especially in China.”

The Response

Central banks are ‘front loading’ rate hikes to try and get on top of inflationary pressures. That is, rates are being lifted more quickly and more aggressively than usual. The fear is that if higher rates of inflation take hold – become cemented in people’s consciousness – then it will take longer to bring the inflation rates back to preferred levels.

The risk with these ‘harder and faster’ rate increases is that they could cause economies to go into recession. Recessions are defined differently across the globe, but in Australia, the general definition of a recession is two consecutive quarters of economic contraction (declines in gross domestic product).

What this means for your mortgage

For a typical owner-occupier with a $500,000 mortgage and 25 years remaining, this increase will see their monthly repayments rise by $137, according to RateCity.

Their total increase to date from the May, June, and July rate hikes would be $333 per month.

For a borrower with a $1 million mortgage, today’s decision will add $273 to their monthly repayments, bringing their total increase to $665 per month since April.

CoreLogic figures also showed national house prices fell for the second consecutive month in June by 0.6 %.

In conclusion

From the statement from the RBA:

“Today’s increase in interest rates is a further step in the withdrawal of the extraordinary monetary support that was put in place to help insure the Australian economy against the worst possible effects of the pandemic. The resilience of the economy and the higher inflation mean that this extraordinary support is no longer needed. The Board expects to take further steps in the process of normalising monetary conditions in Australia over the months ahead. The size and timing of future interest rate increases will be guided by the incoming data and the Board’s assessment of the outlook for inflation and the labour market. The Board is committed to doing what is necessary to ensure that inflation in Australia returns to target over time.”

If you would like a free home loan review from our HG Mortgage broker team, download the below document and return it to us or email mortgages@hrkacgroup.com.au.

The information provided in this blog is of a general nature only and is not intended as either advice or recommendations and is not tailored to your specific circumstances. Please also note that this does include any information on any Payroll requirements imposed by any State or Territory Governments outside of the State of Victoria.

Liability limited by a scheme approved under Professional Standards Legislation.

Among those who have their own business, there’s little doubt that payroll and bookkeeping can present challenges to businesses of all sizes. Handling time and attendance, payroll taxes and workers’ compensation can be difficult for even the most experienced business owners. That’s where payroll services and bookkeeping companies come in. These companies take the stress out of payroll and its related processes by providing intuitive services to companies of all sizes and industries.

It is the responsibility of a bookkeeper to provide accurate, up-to-date financial data so that your accountant can prepare annual financial reports as well as tax returns for your business. These accounting reports can also be used by you as a business owner to help make important decisions for your business.

At The Hrkac Group, we partner with SIBS Bookkeeping Geelong to provide our clients with bookkeeping services. They specialise in payroll services in Geelong and work with you to ensure that your employees are paid on time and that all of your legal obligations as an employer are met, taking the worry out of your payroll processes. This allows you as a business leader to focus on important enterprise tasks instead of worrying about how and when individual employees will be paid. Here’s a breakdown of just a few of the services that a professional Bookkeeper can assist you with.

1. Payroll STP (Single Touch Payroll) Finalisation Process

Single touch payroll is a recent regulation that changed when and how small businesses report payroll activity to the Australian Tax Office (ATO). Businesses used to be required to report this information to the ATO once a year. Now, you must send a report after each payday. And those reports must be submitted digitally, in a specific format. As an employer, You need to make sure you can submit compliant reports every payday.

You also need to make a finalisation declaration by the 14th of July each year. If you do not finalise by this date, you should do so as soon as possible to ensure your employees can access their information to complete their income tax returns. If you can’t make a finalisation declaration by the due date, you will need to apply for a deferral.

If you don’t already use an accountant or bookkeeper, this could be a good time to start. They can take care of your STP requirements throughout the year and also the finalisation process.

2. WorkCover Annual Declarations

You must have a valid Victorian WorkCover Policy if your total remuneration to employees and rateable Subcontractors is $7,500 per annum or more. If you are registered for Victorian WorkCover, you must submit an Annual Declaration to WorkSafe VIC stating the cost of remuneration paid to your workers (including rateable Subcontractors) over the year and an estimate of their remuneration for the following year.

You would usually log in to WorkSafe’s Online Employer Services (OES) to complete the declaration; another set of logins to remember, more data you need to find and keep handy to be compliant. Or, you can have a professional Bookkeeping/payroll service take care of this for you.

(*Please note other Australian States and Territories may have different requirements).

3. Payroll Tax Annual Declarations

The payroll tax applies if you pay wages (including rateable Subcontractors) in Victoria and your Australian remuneration exceeds this year’s monthly threshold of $58,333 (year ended 30th June 2022). There is also the mental health and wellbeing surcharge, which commenced on 1 January 2022. You must pay this surcharge if you pay Victorian taxable wages and your Australian wages exceed the first annual threshold of $10 million, with a first monthly threshold of $833,333. (*Please note other Australian States and Territories may have different requirements).

You must register with the State Revenue Office (SRO) to pay payroll tax where you exceed the relevant monthly threshold regardless of your annual remuneration paid. You will need your payroll records handy to help you. Penalties and interest may apply if you do not register.

Once registered, you can use the SRO’s secure online system Payroll Tax Express (PTX Express) to lodge monthly returns, pay your tax, complete your annual reconciliation, apply for a refund and update your records. If you are registered to lodge and pay monthly, you must submit your wage details every, even if you do not have a payroll tax liability. Employers self-assess their liability on a monthly basis and pay by the seventh day of the following month or the next business day (many businesses are eligible to report and pay on an annual basis depending on their total remuneration paid).

If this all sounds like too much work, payroll tax declarations are a specialty service of Bookkeepers. They can take your Payroll Tax Annual Declaration off your plate so you can get back to running your business.

4. CoINVEST Quarterly lodgements

CoINVEST is the construction industry long-service leave fund in Victoria, governed by the Construction Industry Long Service Leave Act 1997. The scheme was established in 1976 to ensure workers in the construction industry would have access to long-service leave, even if they didn’t remain with a single employer for the required seven years. CoINVEST operates as a fund into which you as a construction industry employer must pay a quarterly contribution fee proportionate to the size of your workforce’s total wages. After seven years of working in the construction industry, workers can claim their long-service leave from CoINVEST.

Every three months, you must complete a ‘Workers’ Days and Wages’ form. You record how many days your employees worked in the quarter and also how much the employee was paid over the same period. CoINVEST will then issue an invoice to be paid, currently based on 2.7 percent of total gross wages reported on the form.

This is something else a qualified bookkeeper can take care of for you; the SIBS Bookkeeping Geelong team is experienced in processing these types of quarterly payments.

5. Portable Long Service Leave Authority (PLSA)

Did you know that the Victorian Government has made permanent Long Service Leave Benefits Portability Regulations that came into effect on 1st October 2020?

Much like Co-Invest works for the relevant trades and construction industries – The PLSA allows workers in community services, contract cleaning, and security to take their long service entitlement with them if they change jobs but stay in the industry. There is a quarterly lodgement and payment required.

6. Incolink Monthly lodgements

Incolink provides a safety net for workers in the commercial building and construction industry where permanency and continuity of employment are significant issues. For you as an employer, Incolink takes care of your redundancy compliance obligations, avoiding any large payouts at the end of projects.

If you have a membership with Incolink, you need to make monthly contributions. This is another specialty service that SIBS Bookkeeping Geelong can assist you with.

7. Paying Superannuation on time

As an employer, you must pay super contributions for your eligible employees to avoid the Super Guarantee charge.

You must pay your employee Super Guarantee contributions electronically to either a complying super fund that meets specific requirements and obligations under super law, or a retirement savings account (RSA) which provides a low-cost and low-risk savings strategy for retirement. Each of your employees may have a different fund which will need to be set up when they join your payroll.

You must pay Super Guarantee contributions by quarterly due dates – 28 days after the end of each quarter to avoid the Super Guarantee Charge Liability *. Some super funds require employers to contribute monthly. By registering with these funds, you agree to make monthly contributions to that fund. You can also arrange to make post-tax super payments on behalf of your employees if they request this.

If this all sounds like a lot of hassle on your behalf, engage the services of a professional bookkeeper. They’ll take this payroll pain off your shoulders to give you back the time you need to run your business.

(*Please note that this is when the Employers or relevant Labour Hire Subcontractors Superannuation Fund must receive the quarterly contribution by – for many clearing houses – you must lodge the Superannuation payment request by around the 14th/15th days after the end of the quarter to avoid the Superannuation Guarantee Charge Liability)

In conclusion

One size does not fit all when it comes to bookkeeping and payroll services. Each individual business and industry comes with its own unique circumstances and requirements. That’s why The Hrkac Group partners with SIBS bookkeeping Geelong. They work with you to simplify your business’s internal processes when it comes to keeping the books up to date through innovative ideas and technology. They work offsite and online, allowing them to complete monthly bookkeeping in record time; ensuring the best results for your business.

Most importantly they give you more time to focus on what’s important to you; running your business. If you’re looking for Payroll Services Geelong, look no further. To learn more about what services SIBS Bookkeeping Geelong can offer you, contact us via email or phone 0488 614 668.

The information provided in this blog is of a general nature only and is not intended as either advice or recommendations and is not tailored to your specific circumstances. Please also note that this does include any information on any Payroll requirements imposed by any State or Territory Governments outside of the State of Victoria. Please contact our partner – SIBS Bookkeeping team or us – the Hrkac Group Accountants team – if you would like assistance as to how, or if, any of the abovementioned would apply to you.

Liability limited by a scheme approved under Professional Standards Legislation.

Financial success can look very different for everyone, whether it’s living debt-free, building an investment portfolio, or prioritising superannuation for early retirement. No matter what financial success looks like to you, there’s one thing that can accelerate your journey there, and that is a strong relationship with an expert Financial Planner.

When looking to engage the services of a local Geelong Financial Planning firm, it is important that their service offerings can accommodate your lifestyle and needs. Perhaps you are time-poor and prefer phone appointments, or value an active role in the management of your investments with regular reviews. At the Hrkac Group, our Financial Planning team are there when you need, and how you need, but there are certain times when scheduling an appointment may be required to keep you on track for financial success.

1. Annual Review

As a part of an ongoing advice service arrangement, your Financial Planner should review your financial position at least once a year. At this annual meeting, your Financial Planner will perform a thorough review of your position and current financial strategies. In particular, they should consider the following;

- Have you experienced any financial changes, such as debt levels, income and expenses?

- Has the level of investment risk you’re comfortable with changed?

- Whether your current personal insurance cover remains appropriate.

- Is your portfolio performing in line with expectations?

- If any changes to legislation or financial products could affect you.

- Are you on track to meet your goals?

2. A big life change.

Marriage, a new baby, death, divorce, moving home, the loss of a job and any other major life-changing event can impact your goals, taxes and debt significantly. Ideally, you should consult your Financial Planner if you’re going through any significant life changes at your earliest convenience.

3. Taking on significant debt.

Purchasing a new car, a new home, starting your own business, or acquiring a large debt can also massively impact your financial plan. Your Financial Planner can help outline the advantages and disadvantages of such major financial decisions, and make amendments to your financial strategies to accommodate.

4. Coming into some money.

If you have inherited a large sum of money or received a significant bonus or promotion at work, a boost to your finances could be a good prompt to meet with your Financial Planner. Your taxes, strategies, and the structure of your portfolio may be impacted. Your Financial Planner can provide insights and recommendations for investing your new windfall.

5. Estate planning

For any major changes to your estate plan, you should meet with your Financial Planner to ensure that your financial plan is structured correctly in light of the changes. Of course, your Financial Planner cannot offer legal advice, but they can ensure that your existing investments and strategies are supportive of your estate plan.

6. Retirement Planning

Preparing for the comfortable retirement you have earned through years of hard work should be at the top of everyone’s list. Whether it’s a distant thought or just around the corner, a Financial Planner can help determine your retirement income needs, maximise your retirement savings and give you the support you need to retire comfortably.

7. Sophisticated Investors

Whether you’re a sophisticated investor, highly diversified or simply prefer to actively monitor and engage with your portfolio, a more regular formal review may be beneficial. The right Financial Planner will be able to tailor an ongoing service package to meet your needs and offer monthly, quarterly, or biannual review services.

One size does not fit all when it comes to financial advice. Aside from initial meetings and annual reviews, financial advice can be beneficial at the many, various turning points in your life. You should always feel comfortable contacting your Financial Planner any time that you are making important decisions that may impact your finances.

If you’re interested in knowing more about what happens when you engage the services of a Financial Planner, speak to our expert Geelong Financial Planning team at The Hrkac Group. They work strategically with you to develop a tailored strategy aimed at achieving your desired financial outcomes.

Our Geelong Financial Planning team considers your individual needs, goals, and objectives. So, whether it’s retirement planning, wealth creation and management, superannuation advice or wealth protection and insurance, you can feel reassured knowing it can be handled under one roof at the Hrkac Group. If you’re looking for Financial Planning Geelong, look no further. To make an appointment to meet one of our friendly team today, feel free to contact us via email or phone 03 5224 2366.

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

If you’re buying or selling a property in Geelong, you may have heard a lot of different terms being thrown around. But don’t be overwhelmed if you haven’t heard the majority of these before. With the help of experienced Geelong conveyancers, you are still more than capable of completing the purchase or sale of a home.

Our friendly Geelong conveyancers at the Hrkac Group have compiled an easy reference guide of some of the most common conveyancing terms to help you through the process. Refer to this glossary of conveyancing definitions as you come across them on your property selling or purchasing journey.

Agent

The real estate agent who the seller, or vendor, has engaged to manage the sale of the property.

Auction

When the sale of a property is conducted in public and is sold to the highest bidder.

Caveat

A caveat is a legal claim lodged against a property by a person with an interest in the property. A caveat will prevent a property from being sold or transferred unless it is removed.

Common property

Areas of a property used by and belonging jointly to all owners of a property. This applies to such properties as apartment blocks or multi-dwelling complexes.

Contract of Sale

A written agreement between the buyer and seller of a property that outlines the terms and conditions of the sale, inclusions, price, descriptions of the property, and completion date.

Cooling off period

A period of three business days which commences from the date when an exchange of contracts has taken place between the purchaser and the buyer of the property. During this time, the purchaser can choose to walk away from the contract, though may be required to forfeit 0.2% of the purchase price. There are some circumstances in which a purchaser can’t cool off, such as buying at an auction.

Covenant

An agreement creating an obligation on the titleholder of a property to do or refrain from doing something. For example, a restrictive covenant could state that no more than one dwelling may be built on the land.

Deposit

A percentage of the purchase price for the property being sold. This amount of money is paid by the purchaser as an assurance that they are going ahead with the purchase of the property in question. This amount is usually held by the estate agent until all paperwork for the purchase of the property has been signed.

Easement

A right to use and access part of the land on the property. This right can belong to someone who is not the landowner. An easement is typically used when access is required for wires and pipes for maintenance of sewage, drainage, and electricity. An easement can also refer to shared driveways and paths on a property.

Encumbrance

Refers to the fact that there’s a mortgage or caveat registered for the property title.

Equity

Having ‘equity in your own house’ refers to the difference between the market value of a property and what is still owing on a mortgage. This will increase as the loan is repaid or as the property’s market value increases.

Finance

Pre-approval is the stage where your bank/lender has confirmed an amount you are able to borrow, based upon your financial position. Finance is not guaranteed at this point and is conditional.

Unconditional Approval is the stage where your bank has carried out all the necessary enquiries, including a valuation on the property it is taking as security and has agreed to formally lend you the funds required for your purchase. This stage is “unconditional” because it doesn’t have any further conditions attached to it, except for the execution of documentation.

Fixtures

Items that are attached to the property and which ownership moves from the seller to the buyer with the property.

Joint ownership

Title to property is held in one of two ways. Joint tenants means that each person owns the property jointly and equally. In the event of one joint tenant surviving the other, the property automatically passes to the remaining joint tenant or tenants. Tenants in common means that each person owns a share (can be 50/50, 70/30, 99/1 or any share you wish) in the property. On the death of one party that share passes to whoever inherits their estate, so having a current Will is essential.

Mortgage

An amount of money loaned to a person or entity that is used to define the purchase of a property. This will be registered on the title to the property and can be used to claim a legal interest in the property purchased.

Mortgagor

The person or entity who receives the mortgage.

Mortgagee

The person or entity who provides the mortgage.

Mortgage guarantee insurance

Paid by the borrower to protect the lender against failure by the borrower to keep up mortgage repayments or to pay back the loan in full when it is due. Such insurance normally applies where the borrower’s loan exceeds 80% of the value of the property. This type of insurance is taken out by the lender, with the cost passed on to the borrower. The borrower remains liable for any shortfall; for example, if the property is sold and the proceeds do not cover what is owed to the lender.

Off the Plan

An ‘Off the Plan’ property is a unit or house that has not yet been built, and you have agreed to buy based on the Developers’ plans.

Owners corporation

Formerly known as a body corporate. An owners corporation has the collective ownership of the common area in a subdivision of land or buildings. It is responsible for the administration, upkeep, and insurance of the common area shared by all the owners (the common property).

Section 32/S32

Information that the seller must provide to the buyer advising of restrictions such as covenants and easements, outgoings such as rates, and any other notices such as compulsory acquisition. Also known as a vendor’s statement.

Settlement

When ownership of a property passes from the seller to the buyer and the balance of the sale price is paid to the seller.

Stamp duty

A state government tax, based on the sale price of a property, paid by the buyer when property ownership is transferred. Also known as duty.

Statement of adjustments

A document that includes all the adjustments of certain costs such as taxes, rates, water, rent, and how they are divided up between the purchaser and the vendor. Until settlement, the vendor must pay all expenses pertaining to the property. These expenses transfer over to the new owner of the property upon completion of the settlement.

Subdivision

The process of dividing one piece of land into different lots. This is a common practice among buyers who wish to buy land with the intention of building multiple houses or units on it.

Subject to finance

A contract clause that states the purchaser of the property in question has to obtain finance for a set amount by a certain date. Failure to do so releases them from the buyer’s contract without a financial penalty.

Title

A legal document identifying who has a right to the ownership of a property.

Transfer of Land

A document recording the change of ownership of a property from the seller to the buyer.

Vendor/Seller

An individual or entity selling land.

Zoning

The permissible uses of an area of land as stipulated by the council.

Geelong Conveyancing

If you’re interested in knowing more about what is required when buying or selling a home, speak to the expert Geelong conveyancers at The Hrkac Group. A smooth property settlement depends on all legal and financial obligations being met, and that can require liaison between a number of different parties including solicitors, lenders, and real estate agents – even representatives of local councils.

Our Geelong conveyancers’ expertise and experience in facilitating a stress-free settlement can help ensure a positive outcome for you. So, whether it’s a change of name or transfer of title, an application for subdivision, or any matter regarding commercial or residential conveyancing, you can rest easy knowing it can be handled under one roof at the Hrkac Group. If you’re looking for Geelong conveyancing, look no further. To make an appointment to meet one of our friendly Geelong Conveyancers today, feel free to contact us via email or phone (03) 5224 2366.

It seems like Superannuation Guarantee requirements are always changing. Just when you think you’ve got all the rules and eligibility criteria committed to memory, they evolve again. Today we’re discussing an important change to superannuation requirements that happened at the beginning of 2020, but it’s worth a reminder: Employers can no longer use money contributed by employees in salary sacrifice arrangements to meet or reduce their legal Superannuation Guarantee Contribution obligations.

Current Superannuation Guarantee legislation requires employers to contribute 10% of an employee’s base salary into their nominated super account. Prior to January 2020, employers could calculate this Superannuation Guarantee amount based on the reduced salary after any salary sacrifices. And because the Superannuation Act made no distinction between a contribution from salary sacrificing or an employer contribution, employers were also able to use employees’ salary-sacrifice super payments to meet their legal Superannuation Guarantee obligation.

This means that employees who believed they were boosting their retirement income by sacrificing part of their salary to pay extra on top of the compulsory amount paid by employers were inadvertently reducing their Superannuation Guarantee entitlements.

Prior to the introduction of this bill, employers typically calculated employees super guarantee contributions using one of three methods:

1. Based on the base salary (before any salary sacrifice is deducted)

| Base salary | $60,000 |

| Salary Sacrifice | $10,000 |

| Taxable Salary | $50,000 |

| Employee Super Guarantee Contribution ($60,000 x 10%) | $6,000 |

Under this method, the salary sacrifice deduction is not considered when calculating the Super Guarantee Contribution.

2. Based on the taxable salary (after any salary sacrifice is deducted)

| Base salary per quarter | $60,000 |

| Salary Sacrifice | $10,000 |

| Taxable Salary | $50,000 |

| Employee Super Guarantee Contribution ($50,000 x 10%) | $5,000 |

Under this method, the salary sacrifice amount is excluded from the Super Guarantee Contribution calculation and the final superannuation calculation is lower than Method 1.

3. The salary sacrifice amount is considered as part of the Superannuation Guarantee contribution by the employer

| Base salary per quarter | $60,000 |

| Salary Sacrifice (Included in SGC calculation) | $10,000 |

| Taxable Salary | $50,000 |

| Super Contribution | $10,000 |

Under this method, the employee’s salary sacrifice amount is included by the employer as part of their Employee Super Guarantee Contribution and no additional employer superannuation contributions are paid.

This is where the big change comes in. The Treasury Laws Amendment (2019 Tax Integrity and Other Measures No. 1) Bill 2019, came into effect January 2020. With the introduction of this bill, the Superannuation Guarantee contribution will need to be calculated using the first method listed above only, based on the employee’s salary base.

Since January 1 2020, employers have been required to pay the minimum Superannuation Guarantee Contribution calculated on their employees’ base salary, including any salary sacrifice amount, into their super to avoid the super guarantee charge. It also prevents employers from using any salary sacrifice contributions made by employees to meet their minimum Superannuation Guarantee Contributions.

Reporting requirements also changed. If an employer makes super contributions under a salary sacrifice arrangement or makes extra super contributions to a super fund for an employee, these extra contributions may need to be reported on your employee’s payment summary.

Unsure if you’re meeting your superannuation contribution requirements?

If you’re interested in knowing more about Superannuation Guarantee Contributions or reporting requirements, speak to an expert Geelong accountant at The Hrkac Group. when it comes to minimising your taxation liabilities and maximising your income, our team of Geelong accountants at The Hrkac Group is there to help you with practical, effective advice.

Take control of your tax planning and minimisation needs by meeting with one of the business accounting specialists at The Hrkac Group. To make an appointment to meet one of our friendly team today, feel free to contact us via email or phone (03) 5224 2366.

This information has been provided as general advice. We have not considered your financial circumstances, needs, or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

A credit score is a number representing your financial history. It is calculated using the information in your credit report, which includes your payment history, the number and type of accounts you have, the amount of debt you have, as well as the length of your credit history. If you’re in the market for credit or a loan, it’s in your interest to boost your credit score as much as you can.

Credit scores are taken into consideration by potential lenders and creditors when determining whether or not to approve an applicant for credit. For example, if you’re applying for a home or business loan your mortgage broker may discuss your credit score with you. It can serve as an indication as to how likely you are to pay back the loan.

Your credit score will typically sit on a scale of zero to 1,000 or zero to 1,200, depending on the credit reporting agency. Higher credit scores demonstrate responsible past credit behaviour, which may instil more confidence in potential lenders and creditors when they are evaluating a request for credit. If you have a lower score, financial institutions will be less inclined to allow you to borrow large sums. If they do, your interest rates may be higher – as motivation to repay the loan sooner rather than later.

Here’s a general breakdown of credit score ranges from the three major credit agencies in Australia:

| Credit Score Range | Illion | Equifax | Experian |

| Excellent | 800 – 1000 | 833 – 1200 | 800 – 1000 |

| Very good | 700 – 799 | 726 – 832 | 700 – 799 |

| Average | 500 – 699 | 622 – 725 | 625 – 699 |

| Fair | 300 – 499 | 510 – 621 | 550 – 624 |

| Low | 0 – 299 | 0 – 509 | 0 – 549 |

It’s important to remember that everyone’s financial and credit situation is different, and there is no perfect score that will guarantee better loan rates and terms.

Now that we’ve established what credit scores are all about, here are 5 tips to keep front of mind if you want to boost your credit score and establish or maintain responsible credit behaviours:

1. Pay your bills on time, every time.

A record of consistent and punctual payments can contribute to a stronger credit score. This includes all your bills. Late or missed payments on credit cards, mobile phones, utilities, or your rent may be reported to credit agencies, which will likely negatively affect your credit scores. If you’re having trouble with paying a bill, contact the service provider immediately to ask about alternative arrangements or payment plans. Avoid skipping payments, even if you’re contesting a bill. Creating a monthly budget and scheduling automatic payments for bills and other repayments could help you avoid late or missed repayments.

2. Pay off your debts promptly.

Again, having evidence of prompt repayments will contribute to a strong credit score. On the other hand, making late payments can damage your credit. Although paying off a debt can initially cause scores to dip temporarily, in general you could see an improvement in your credit as soon as one or two months after you pay off the debt.

3. Keep your credit card balance below the limit.

A higher balance compared to your credit limit may negatively impact your credit score. Keeping your balance low with consistent and on-time repayments will look good on your credit report. Limit new applications for credit or loan products where you can and if appropriate, consider lowering the limit on any credit cards you have. This will put a firmer limit on the amount of debt you can accrue.

4. Apply for credit cautiously.